The Rise of Agentic AI in Telecom: A Transformational Shift

Report Overview

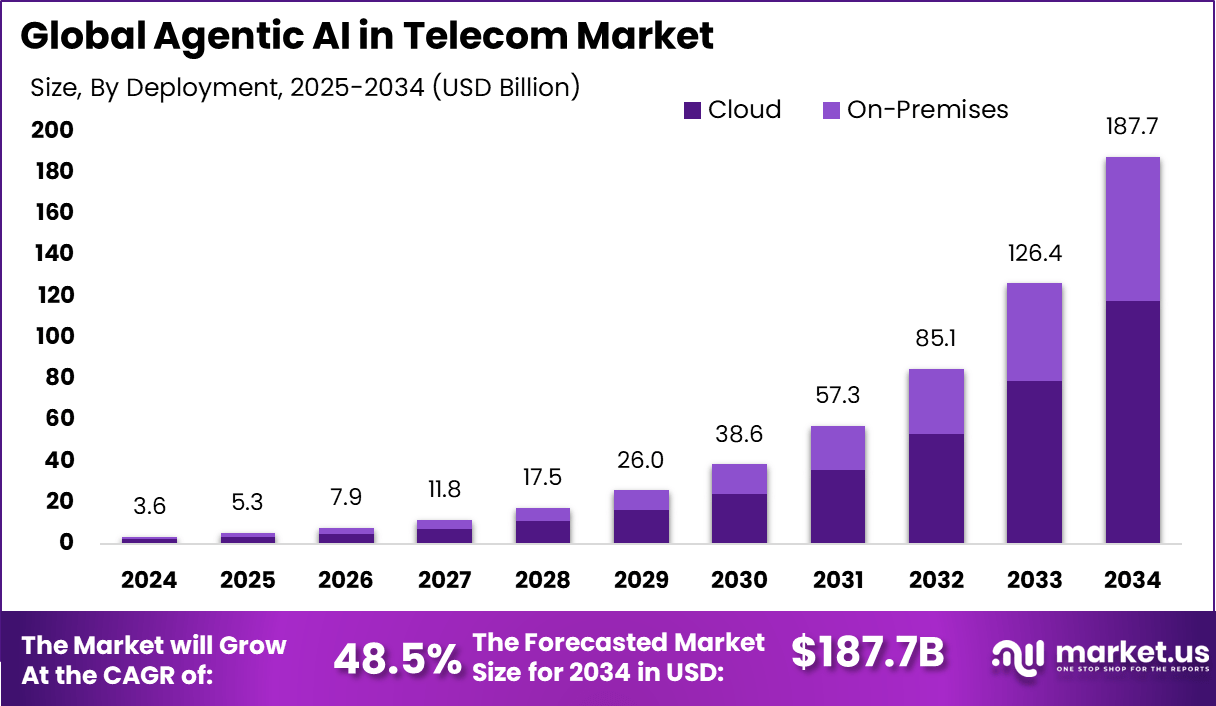

The Global Agentic AI in Telecom Market is set for a remarkable transformation, projected to soar to approximately USD 187.7 Billion by 2034. Starting from USD 3.6 billion in 2024, this sector is anticipated to grow at an astounding CAGR of 48.5% through 2025 to 2034. North America dominates this emerging market, capturing over 34.8% with revenues around USD 1.2 Billion in 2024.

Agentic AI signifies a milestone in how telecommunications operators are leveraging autonomous AI models to refine operations, enhance customer experiences, and augment network intelligence. It refers to AI systems designed to act autonomously, make decisions, and demonstrate a high degree of contextual awareness. This capability allows telecom companies to improve network management, combat fraud, enable predictive maintenance, and elevate customer interaction experiences.

Growth Drivers and Market Forecast

A significant driver of growth in the agentic AI sector is the escalating complexity of network infrastructures, fueled by technological advancements like 5G, the Internet of Things (IoT), and edge computing. In this evolving landscape, managing dynamic networks is essential. Agentic AI systems are proving invaluable by autonomously addressing network failures, foreseeing congestion issues, and suggesting optimal routing strategies.

Telecom operators are increasingly in search of AI solutions that move beyond mere rule-based automation. The ability of agentic AI to mimic human-like reasoning while functioning independently greatly appeals to firms seeking reduced operational costs and efficient traffic management.

According to Market.us, projections indicate growth for the Global Agentic AI Market, expanding from USD 5.2 billion in 2024 to about USD 196.6 billion by 2034, at a remarkable CAGR of 43.8%.

Key Insight Summary

- The agentic AI in telecom market is forecasted to escalate from USD 3.6 billion in 2024 to roughly USD 187.7 billion by 2034, driven by increasing demand for intelligent network management and operational automation.

- In 2024, North America leads the market with a 34.8% share, generating about USD 1.2 billion, thanks to early adoption and substantial investments in next-generation infrastructure.

- Within North America, the U.S. contributed USD 1.06 billion in 2024, with an expected CAGR of 45.4%, highlighting strong AI adoption to optimize IT operations and enhance service delivery.

- Cloud-based solutions dominate deployment modes, capturing 62.7% of the market, preferred for agility and cost-effectiveness in ever-evolving telecom environments.

- Natural language processing (NLP) technology holds a 38.7% market share, pivotal for enabling advanced customer interactions and support interfaces.

- Network and IT operations management comprised 32.6% of applications, driven by the necessity for reliability and automation in telecom infrastructure.

U.S. Market Size

The U.S. Agentic AI in Telecom Market was valued at USD 1.1 Billion in 2024 and is expected to balloon to approximately USD 44.8 Billion by 2034, reflecting a robust CAGR of 45.4% throughout the forecast period.

![]()

In 2024, North America prominently held over 34.8% market share, reflecting its competitive edge in the AI-integrated telecommunications landscape. The region’s rapid 5G rollout and integration of AI-powered network management solutions underpin its market dominance.

In the U.S. and Canada, telecom providers are focusing on agentic AI to streamline operations, manage bandwidth more efficiently, and improve customer interactions through advanced virtual agents. The transition to AI-led decision-making has notably increased operational agility.

Deployment Models

In this rapidly evolving sector, cloud deployment has emerged as the backbone of agentic AI adoption, capturing an impressive 62.7% market share. This shift is attributed to the imperative need for agility, scalability, and cost efficiency as telecom operators contend with vast data and increasingly intricate networks.

Cloud-based systems facilitate prompt deployment of agentic AI across networks, providing flexibility to respond to demand fluctuations—such as during major events or unexpected service outages. This scalability is crucial in an environment characterized by exponential data growth.

Furthermore, cloud deployment sustains the continuous evolution of AI functionalities, supporting real-time updates and collaborative efforts across diverse regions. Telecom companies can then proactively troubleshoot network issues, optimize resources, and introduce innovative services at a speed unattainable with traditional systems.

Technological Insights

Natural Language Processing (NLP) technology is making headway in the agentic AI landscape, contributing a significant 38.7% share. NLP enables agentic AI systems to understand and engage with customers via human language, fundamentally altering customer interactions.

This advancement revolutionizes user experiences, allowing mundane queries to be resolved quickly and intuitively. Furthermore, it streamlines workflow management for field technicians, reducing error rates and accelerating resolution times.

Internally, NLP applications automate various tasks, including ticketing and network analysis, enabling telecom operators to manage both routine and intricate scenarios with greater efficiency.

Application Segmentation

Regarding applications, network/IT operations management holds a dominant 32.6% share, underscoring the urgent need for intelligent automation in core telecom functions. Traditional management methods can no longer sustain the growing complexity of telecom infrastructures.

Agentic AI alters the dynamics by fostering networks that can self-monitor, self-heal, and self-optimize, reducing human intervention. It enables telecom operators to predict outages, resolve issues promptly, and maintain optimal performance levels.

These intelligent frameworks do not merely react; they proactively manage maintenance, prioritize workflows, and facilitate real-time decision-making, enhancing overall operational efficacy.

Key Market Segments

By Deployment:

- Cloud-based Solutions

By Technology:

- Natural Language Processing (NLP)

- Machine Learning and Deep Learning

- Others

By Application:

- Network/IT Operations Management

- Customer Service and Marketing VDAS

- CRM Management

- Radio Access Network

- Customer Experience Management

- Predictive Maintenance

- Fraud Mitigation

Regional Insights

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Market Dynamics

The agentic AI in telecom sector is on a growth trajectory, driven by the increasing complexity of networks and the need for agile, intelligent solutions. As companies vie for competitive advantage, the shift toward autonomous, AI-driven operations is not merely an option—it’s a necessity to navigate the evolving telecommunications landscape.

Key Player Analysis

Leading names in the Agentic AI in Telecom arena include IBM Corporation, Microsoft, and Intel Corporation. These firms are at the forefront of innovation, enhancing network automation, predictive maintenance, and service personalization through their advanced platforms.

Other notable players include Google LLC, AT&T Intellectual Property, and Cisco Systems, Inc., pioneering intelligent agent technologies for traffic management and resource allocation.

Nuance Communications, Evolv Technologies Holdings, and Infosys Limited are also crucial for deploying virtual assistants and optimization tools, significantly streamlining workflows.

Top Key Players Covered:

- IBM Corporation

- Microsoft

- Intel Corporation

- Google LLC

- AT&T Intellectual Property

- Cisco Systems, Inc.

- Nuance Communications

- Evolv Technologies Holdings

- H2O.ai

- Infosys Limited

- Salesforce, Inc.

- NVIDIA Corporation

Recent Developments

- In July 2025, Capgemini acquired WNS, positioning itself as a leader in AI-powered intelligent operations for telecom, promoting competition and innovation.

- In April 2024, IBM’s acquisition of HashiCorp solidified its AI automation portfolio, helping operators manage complex telecom environments through enhanced automation technologies.

As the agentic AI sector continues to evolve, these actions highlight the aggressive strategies companies are employing to lead in AI advancements within telecommunications.