World Robotics 2025 Report by International Federation of Robotics Released

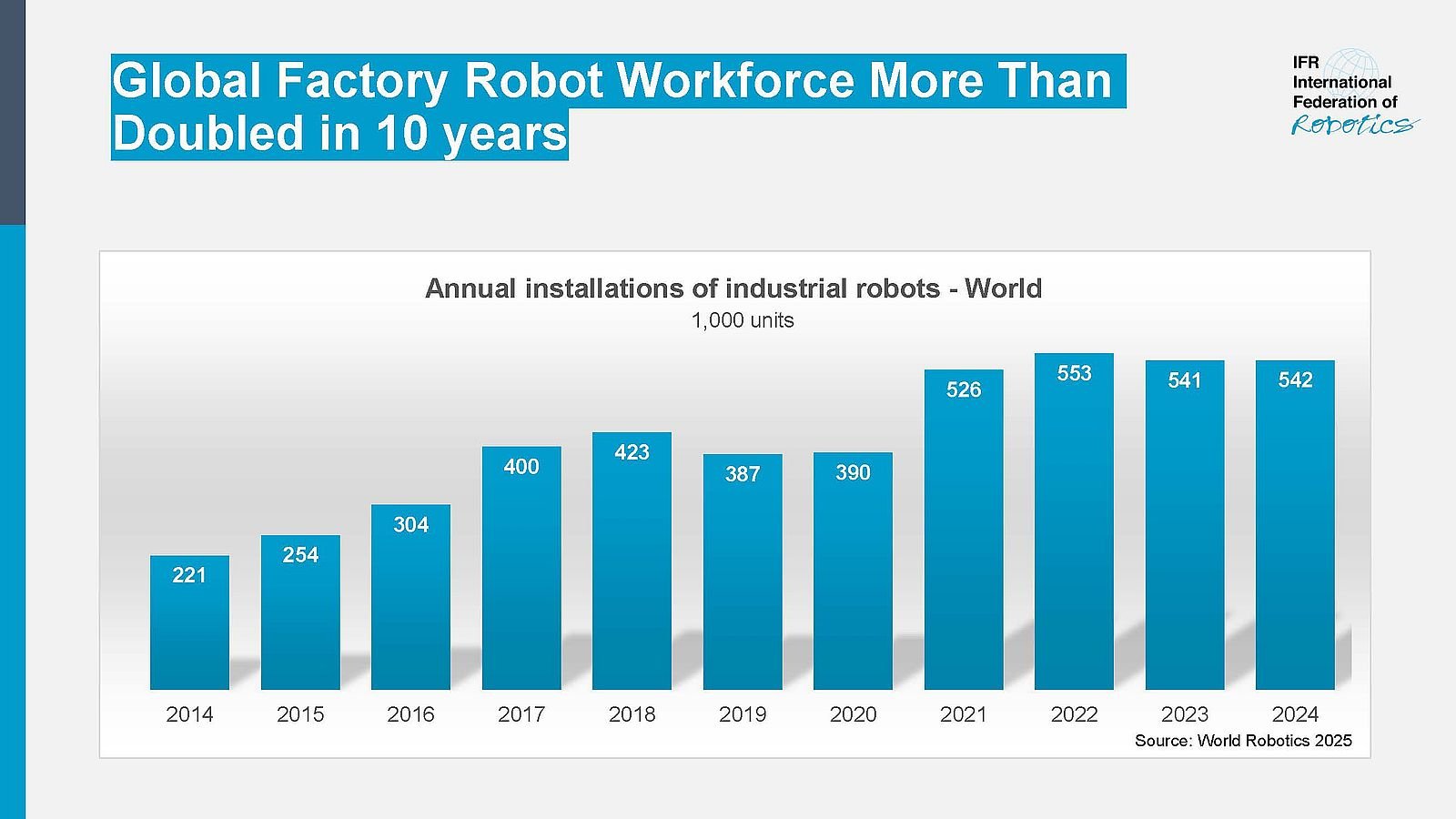

Frankfurt, Sep 25, 2025 — The International Federation of Robotics has unveiled the World Robotics 2025 report, revealing some remarkable statistics regarding the state of industrial robotics. In 2024, a staggering 542,000 industrial robots were installed worldwide, marking over a twofold increase compared to a decade ago. Additionally, this marks the fourth consecutive year that annual installations have surpassed the 500,000 mark. Notably, Asia dominated the landscape, accounting for an impressive 74% of new deployments, contrasted with only 16% in Europe and 9% in the Americas.

“2024 saw the second-highest annual installation count of industrial robots in history—only 2% lower than the all-time high recorded two years ago,” stated Takayuki Ito, President of the International Federation of Robotics. “This surge reflects the ongoing transition of many industries into the digital and automated age, generating a substantial increase in demand. The total operational stock of industrial robots reached 4,664,000 units in 2024, indicating a promising 9% growth compared to the previous year.”

Asia, Europe, and the Americas: An Overview

China emerged as the world’s largest market for industrial robots in 2024, constituting 54% of global deployments. The country installed a record-breaking 295,000 robots, signifying a major milestone. For the first time, domestic manufacturers outsold foreign suppliers in China, raising their market share to 57%—a remarkable increase from about 28% over the past decade. China’s operational robot stock has crossed the 2 million mark, making it the largest in the world. The demand for robots shows no signs of waning, with projections indicating a potential 10% growth average annually until 2028.

Japan remains the second-largest market for industrial robots, with 44,500 units installed in 2024—a modest 4% decline from last year. However, the total operational stock rose by 3%, now totaling 450,500 units. Forecasts suggest that demand for robots will see slight growth in lower single-digit rates for 2025, gradually accelerating to medium single-digit growth in subsequent years.

The market in the Republic of Korea installed 30,600 units in 2024, a decrease of 3%. The trend has remained relatively stable since 2019, with installations hovering around 31,000 units annually. This positions South Korea as the fourth-largest market globally, just trailing behind the United States, Japan, and China.

In India, the momentum continued with a record 9,100 units installed in 2024, representing a 7% increase. The automotive industry was a strong contributor, holding a 45% market share. India now ranks sixth worldwide in terms of annual installations, moving up a rank and surpassing Germany.

Insights into Europe

In Europe, the trend took a slight downturn, with industrial robot installations falling by 8% to 85,000 units in 2024. Despite this decline, it is still the second-largest number recorded in history, with 80% of installations occurring in the European Union (67,800 units). The nearshoring trend has bolstered robot demand in Europe, which enjoyed an average growth rate of 3% from 2019 to 2024.

Germany holds the title of the largest robot market in Europe and ranks fifth globally. Installations decreased by 5% to 26,982 units in 2024, a commendable result second only to the record year of 2023, representing 32% of Europe’s total installations. Italy follows as the second-largest market in Europe, albeit with a 16% decrease to 8,783 units. Spain has risen to third place with 5,100 units, buoyed by strong demand from the automotive sector. In contrast, France dropped to fourth place with 4,900 units, reflecting a significant 24% decrease.

The UK saw a sharp decline in installations, dropping 35% to just 2,500 units in 2024. The previous year’s peak of 3,800 units was primarily a result of the “super-deduction” tax credit program, which concluded after the first quarter of 2023. The UK now ranks 19th globally in robot installations.

Market Activity in the Americas

In the Americas, robot installations surpassed 50,000 units for the fourth consecutive year, totaling 50,100 units in 2024—a decline of 10% compared to 2023.

The United States remains the largest regional market, accounting for 68% of installations in the Americas. However, there was a 9% drop, resulting in 34,200 units installed. Most robots utilized in the U.S. are imported from Japan and Europe, with a limited number of domestic suppliers, although numerous local system integrators are actively implementing automation solutions.

In Mexico, total installations reached 5,600 units, reflecting a 4% decrease. The automotive sector remains the primary customer, accounting for 63% of installations in 2024.

Meanwhile, Canada experienced a 12% decline, registering 3,800 units installed. The robotic installation figures in Canada are significantly influenced by the investment cycles within the automotive industry, with 47% of installations attributed to this sector.

Forward-Looking Perspective

The OECD and IMF project global growth rates between 2.9% and 3.0% for 2025, with similar figures for 2026. However, ongoing geopolitical tensions, violent conflicts particularly in Eastern Europe and the Middle East, and significant trade disruptions are casting shadows over the global economic landscape.

While the robotics industry is not immune to these macroeconomic conditions, the long-term growth trend remains robust. Regional trends may differ considerably, yet the aggregate global outlook appears decidedly positive. Projections indicate that global robot installations could grow by 6% to approximately 575,000 units in 2025, with expectations to surpass the 700,000-unit milestone by 2028.

Contact Information

For further information, please contact the International Federation of Robotics:

PRESS OFFICER

Carsten Heer

Phone: +49 (0) 40 822 44 284

E-Mail: [email protected]

Downloads

To access the global press release in German, as well as comprehensive market presentations and graphs, please refer to the listed resources. Additional press releases are available, focusing on specific markets including Europe, China, the Americas, India, and Germany.