Report Overview

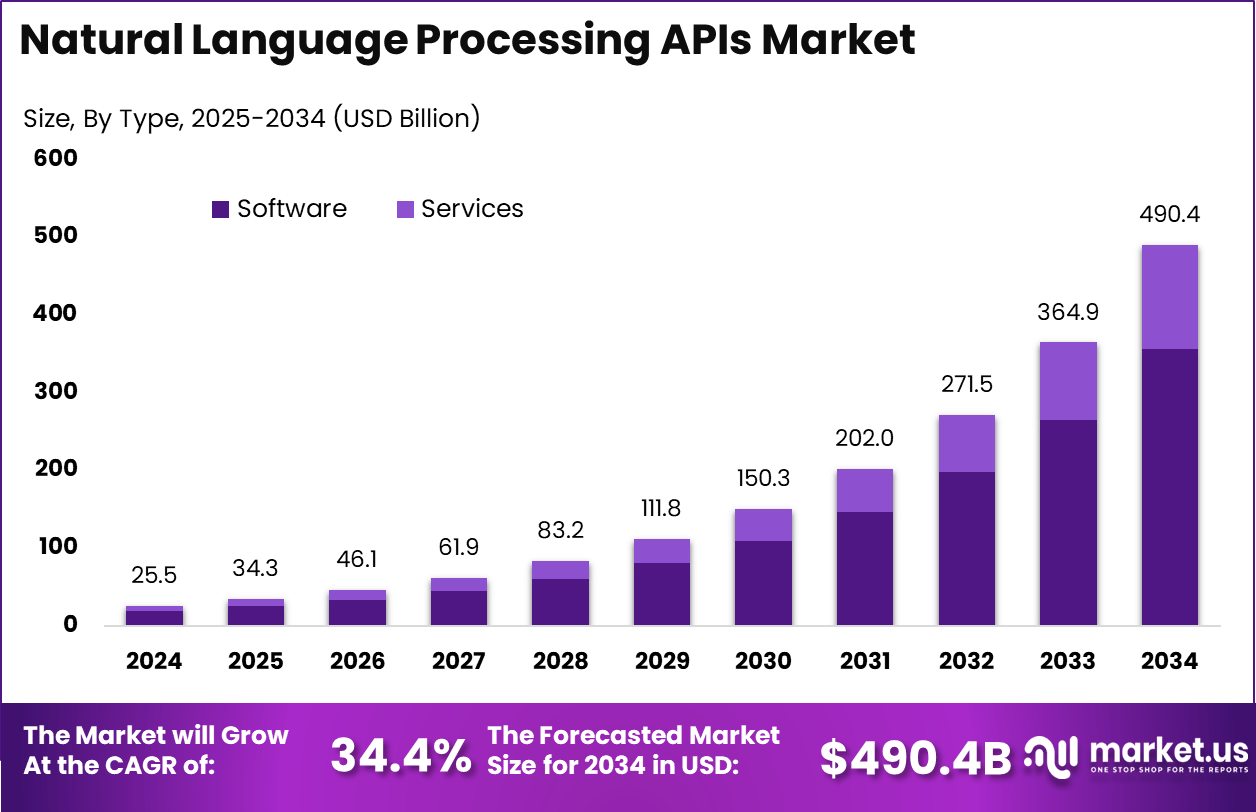

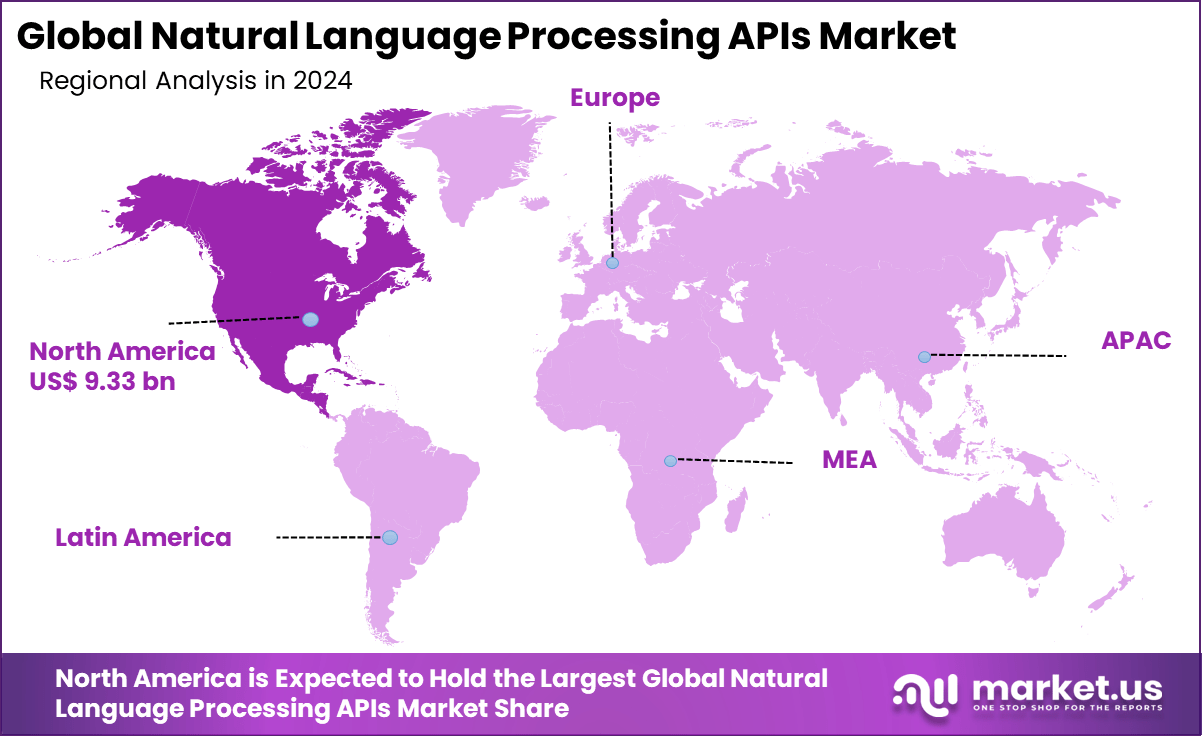

The Global Natural Language Processing APIs Market is poised for exponential growth, expected to reach an estimated USD 490.4 billion by 2034, up from USD 25.5 billion in 2024. This represents an impressive CAGR of 34.4% during the forecast period from 2025 to 2034. Leading this market, North America currently commands a major share, capturing over 36.6% of the total market, translating to USD 9.33 billion in revenue as of 2024.

Key Takeaway

Several significant trends define the landscape of Natural Language Processing (NLP) APIs:

- The Software segment is the market leader, holding a substantial 72.8% share, driven by strong enterprise demand for packaged NLP solutions that simplify integration.

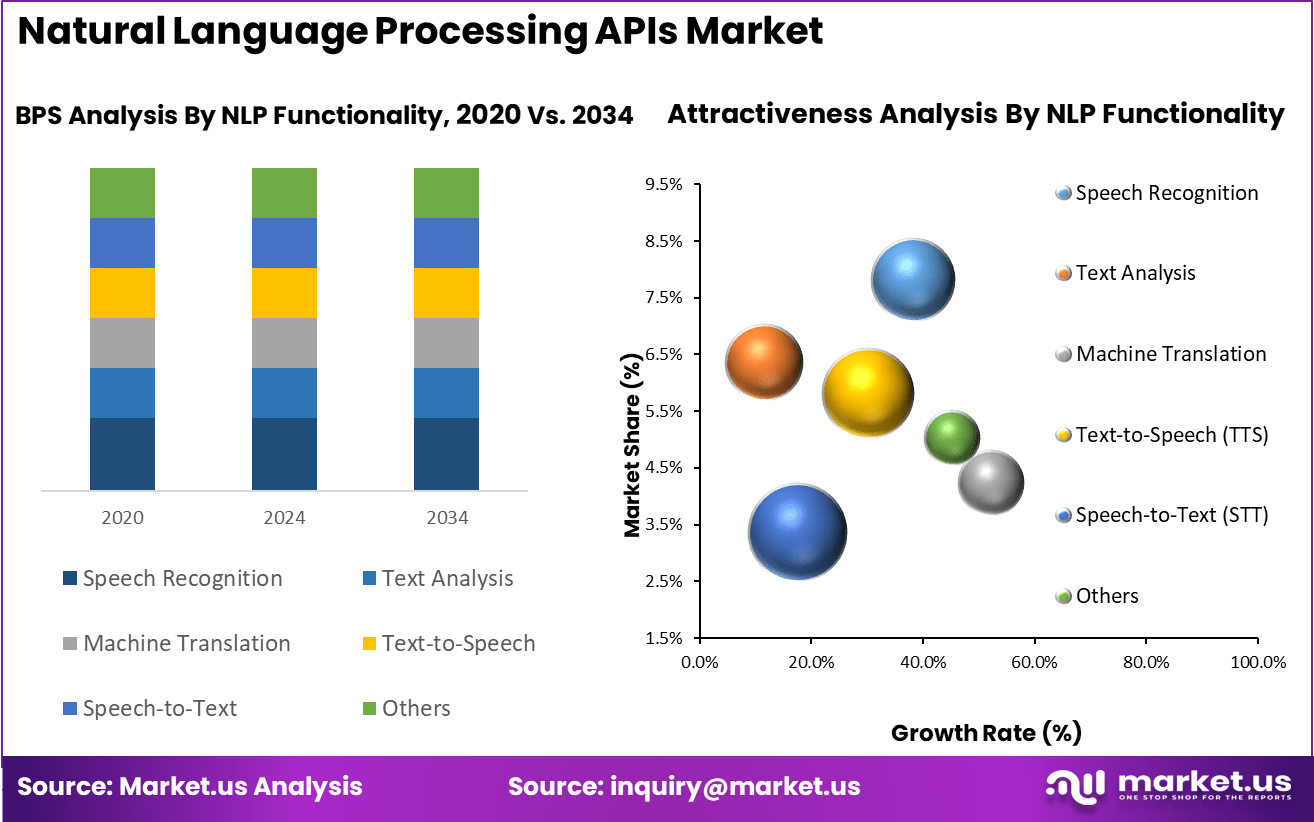

- Speech Recognition technology takes the lead within its category, accounting for 28.9% of the market, fueled by the rise of voice-enabled applications and virtual assistants.

- Large Enterprises dominate, representing 70.3% of the market, harnessing NLP APIs to manage extensive unstructured data and elevate customer engagement.

- The Pay-Per-Use pricing model is favored, making up 65.5% of the market, appealing to businesses seeking financial flexibility.

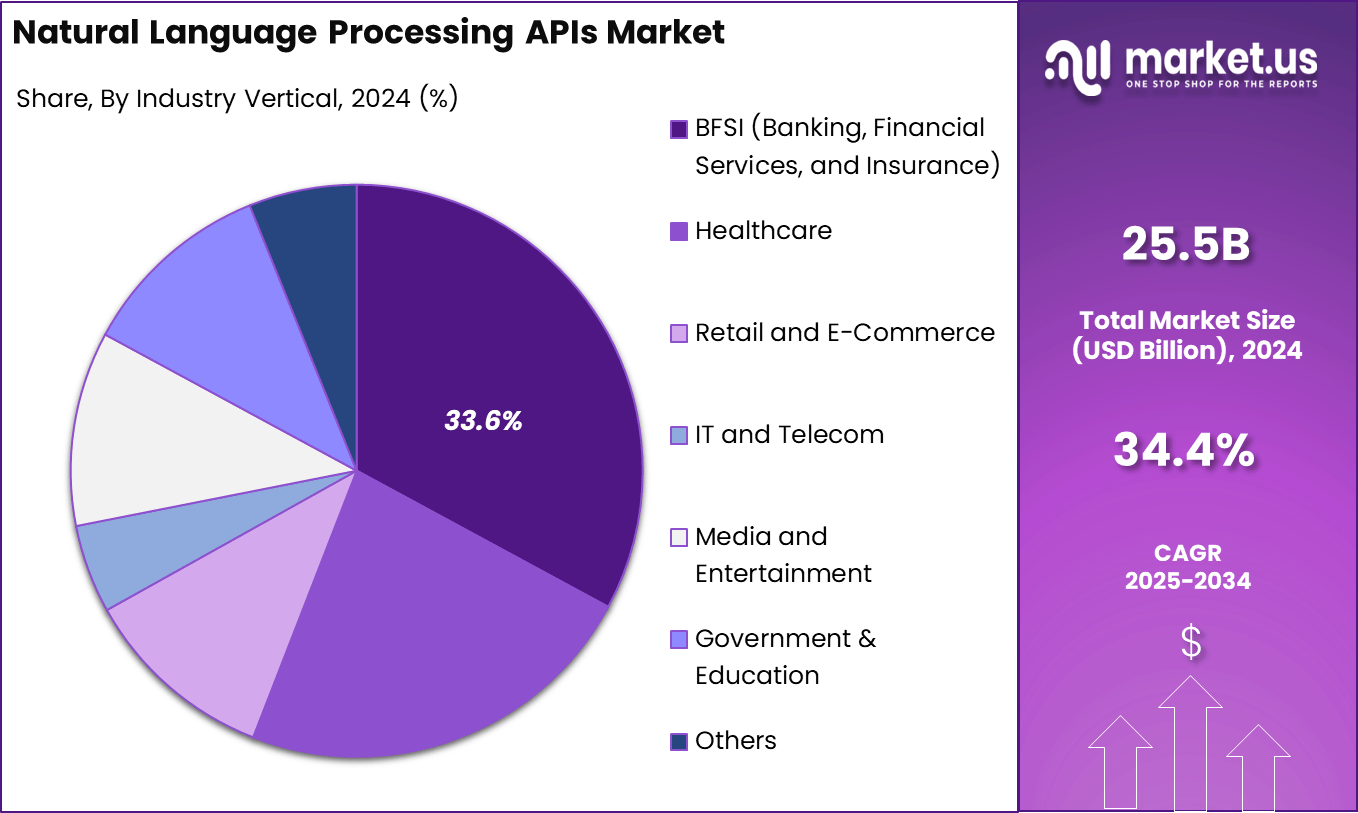

- The Banking, Financial Services, and Insurance (BFSI) sector commands a 33.6% share, utilizing NLP APIs for various operational efficiencies, including fraud detection and customer support.

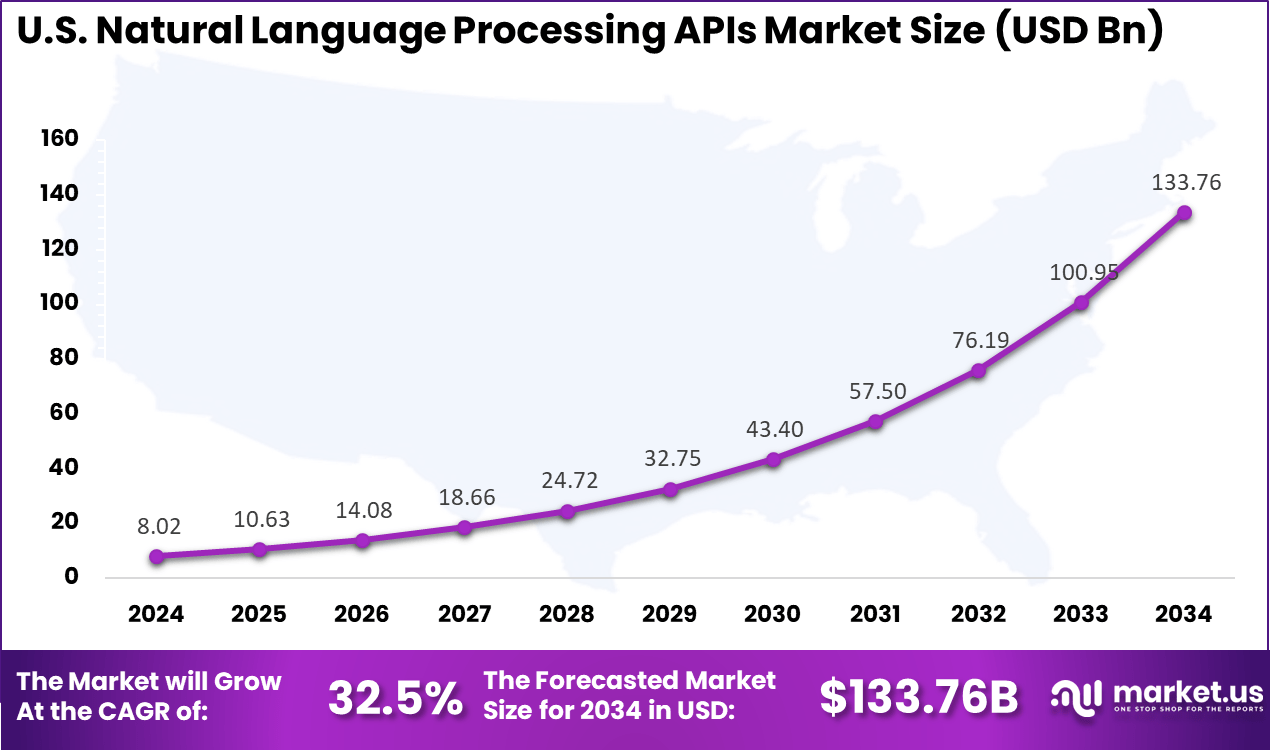

- Valued at USD 8.02 billion in 2024, the U.S. market is anticipated to grow at a CAGR of 32.5%, showcasing rapid industry adoption and innovation.

Market Size and Growth

The NLP APIs market comprises services that facilitate the integration of language understanding, sentiment evaluation, and entity recognition into applications via standardized interfaces. By leveraging machine learning, particularly transformer-based language models, these APIs allow enterprises in sectors like healthcare and retail to enhance customer service and analyze unstructured data.

The drive towards NLP APIs stems from advancements in machine learning, increasing demand for cloud-based AI solutions, and the need for operational scalability. Industries are tapping into NLP capabilities to automate customer interactions, analyze extensive data sets, and support multilingual applications.

U.S. NLP APIs Market Size

The U.S. NLP APIs market is witnessing remarkable growth, currently valued at USD 8.02 billion and projected to experience a CAGR of 32.5%. The surge is largely propelled by the demand for AI-driven customer support tools, such as chatbots and virtual assistants, fostering better customer engagement. As vast amounts of unstructured data continue to accumulate from sources like social media and IoT, effective sentiment and data analysis become increasingly crucial.

In this vibrant ecosystem featuring tech giants like Google and Microsoft, recent innovations have pushed the boundaries of NLP capabilities. For example, in March 2025, a U.S.-based startup introduced an NLP tool aimed at the public sector, enabling government agencies to efficiently analyze vast datasets.

Regional Analysis

In 2024, North America emerged as the dominant force in the Global NLP APIs Market, capturing 36.6% share with USD 9.33 billion in revenue. This dominance is bolstered by a robust technological infrastructure and a strong inclination towards AI solutions. The presence of major tech firms not only propels innovation but also facilitates extensive adoption of NLP technologies across sectors such as healthcare, finance, and e-commerce.

For example, in June 2024, Oracle launched its APEX AI Assistant, empowering enterprise application development through natural language interfaces. Such examples highlight North America’s leadership and commitment to advancing NLP technologies.

Solution Analysis

As of 2024, the Software segment holds a commanding 72.8% share of the natural language processing API market. AI-powered software that encompasses chatbots, sentiment analysis, and automated content generation is vital for enhancing customer engagement and operational efficiency. This demand reflects an increasing reliance on versatile NLP solutions across various sectors.

In November 2021, Cohere released its language model API, allowing businesses to integrate advanced NLP capabilities such as summarization and sentiment analysis into their applications.

NLP Functionality Analysis

The Speech Recognition segment led the market with 28.9% of the share in 2024, a trend attributed to the increasing adoption of voice-driven devices and virtual assistants. This technology is elevating user experience across numerous industries.

As communication preferences shift towards hands-free interactions, sectors like healthcare and automotive harness speech recognition to enhance accessibility and efficiency. Recent advancements, such as Zoho’s AI model featuring integrated speech recognition launched in July 2025, emphasize the potential of NLP in streamlining operations.

Enterprise Size Analysis

In 2024, the Large Enterprises segment captured a significant 68% share of the NLP APIs market. Large organizations leverage NLP technologies for automating customer support and enhancing data analytics. Their capacity for investment in advanced solutions fosters the deployment of scalable, AI-driven applications.

For instance, Lexalytics expanded its capabilities to support additional languages in January 2023, a move designed to assist global enterprises in managing diverse multilingual datasets more effectively.

Pricing Model Analysis

The Pay-Per-Use segment dominated, accounting for 65.5% of the NLP APIs market. This flexible pricing model caters to businesses looking for scalable solutions without hefty upfront costs, especially appealing to SMEs. It encourages wider adoption across various sectors.

In June 2025, Postbot introduced its Pay-As-You-Go AI receptionist powered by NLP APIs, making advanced communication tools accessible to smaller businesses.

Industry Vertical Analysis

In 2024, the BFSI (Banking, Financial Services, and Insurance) segment held a prominent 33.6% market share. The growing emphasis on automation and enhanced customer experience defines the BFSI sector’s increasing reliance on NLP APIs for tasks like sentiment analysis and fraud detection.

A noteworthy example is HSBC, which unveiled an NLP service for investor clients in June 2023, utilizing advanced processing to deliver real-time insights and tailored recommendations.

Top Growth Factors

The surge in AI and automation demand is a significant driver for NLP APIs. Businesses are integrating NLP for customer support automation, sentiment analysis, and content creation, aiming to enhance operations and customer relationships.

For instance, in July 2025, IBM’s acquisition of Seek AI exemplifies efforts to enhance data analytics capabilities, highlighting the continued push for AI-driven solutions in various markets.

Restraint: Privacy and Data Security Concerns

With the processing of sensitive personal data, the adoption of NLP APIs raises concerns over privacy and compliance with regulations like GDPR. Businesses must implement stringent data protection measures.

Penn State University has offered innovative solutions, such as a honeypot security technique, to address these challenges while safeguarding sensitive information.

Opportunities: Growth in Healthcare and Legal Industries

The healthcare and legal domains present vast opportunities for NLP APIs. From analyzing medical records to automating legal document processes, NLP can elevate operational efficiency.

In March 2025, Ping An Health’s launch of AI avatars utilizing NLP showcases the potential of AI to provide healthcare services, signaling a substantial market opportunity in this sector.

Challenges: Competition and Market Fragmentation

The highly fragmented NLP API market poses challenges for newcomers. Established entities like Google and Microsoft dominate, making it challenging for smaller companies to compete effectively.

For example, IBM’s introduction of a new language model in October 2024 reflects ongoing innovations that intensify market competition.

Key Players Analysis

Leading companies like IBM, Google, Microsoft, and Amazon Web Services are at the forefront, continuously enhancing AI capabilities in NLP. Meanwhile, specialized providers like Lexalytics and SpaCy focus on domain-specific innovations.

Emerging players such as Cloudmersive, LLC and OpenXcell are also carving out niches through tailored NLP API services.

Top Key Players in the Market

- International Business Machines Corporation

- Google LLC

- Microsoft

- Amazon Web Services, Inc.

- Lexalytics

- SpaCy

- Wit.ai Inc.

- Cloudmersive, LLC

- OpenXcell

- DataToBiz

Recent Developments

- August 2024: Google acquires Character.AI, enhancing its NLP offerings.

- June 2023: Lexalytics is recognized as the "Best Overall NLP Company" at the AI Breakthrough Awards.

Report Scope

The report captures a detailed overview of the NLP APIs market, market segments, growth drivers, restraints, opportunities, and a competitive landscape analysis, providing a comprehensive understanding of the current market dynamics and future trends.