Report Overview

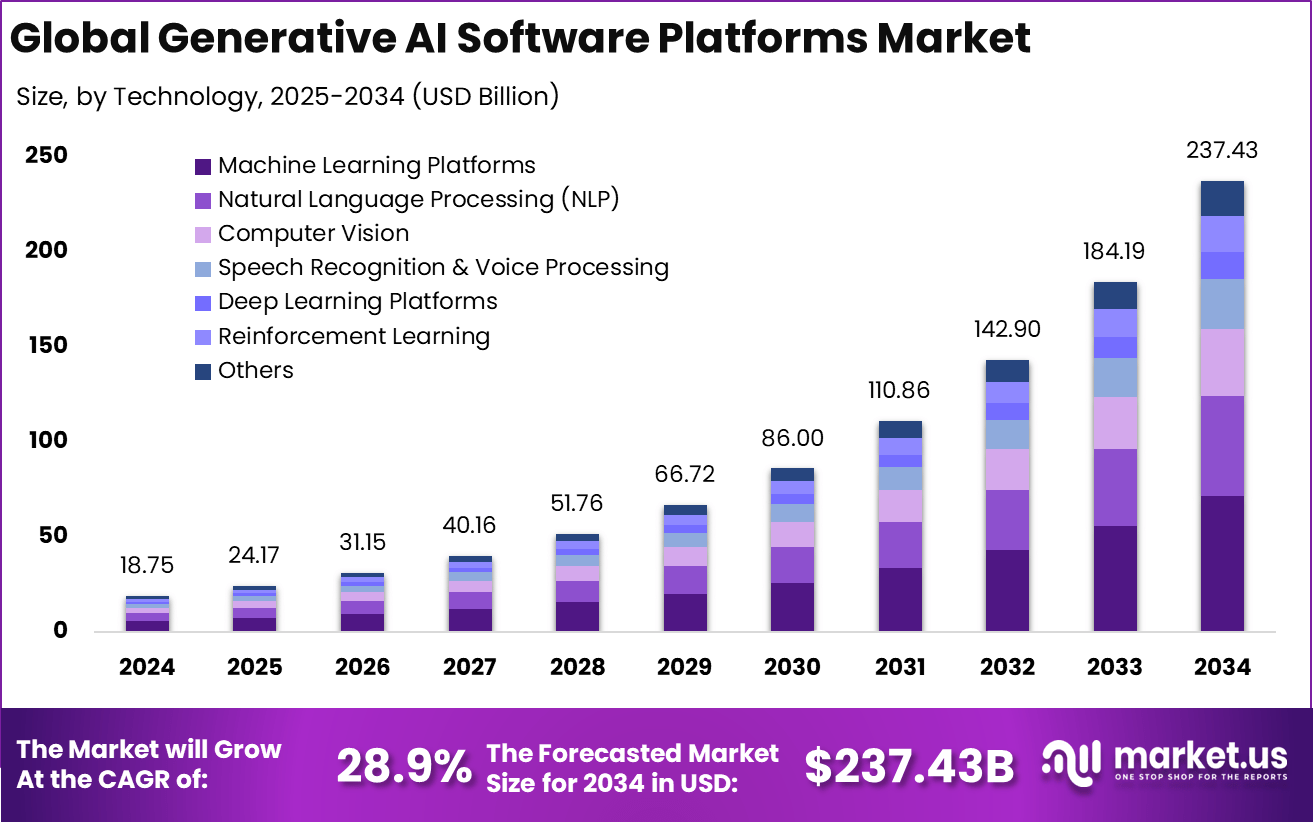

The Global Generative AI Software Platforms Market is poised for remarkable growth, projecting to reach USD 237.43 billion by 2034, up from USD 18.75 billion in 2024. This translates to a significant compound annual growth rate (CAGR) of 28.9% over the forecast period from 2025 to 2034. Notably, in 2024, North America captured over 35.4% of the market share, equivalent to approximately USD 6.63 billion in revenue.

The surge in the Generative AI software platforms market can be attributed to the integration of AI-driven content creation, automation, and decision-making capabilities within business workflows. Generative AI, leveraging advanced machine learning techniques, is capable of generating original content—ranging from text to images, audio, and video—by learning intricate patterns from existing datasets.

For instance, during the October 2024 MAX conference, Adobe showcased an exciting announcement: a new suite of AI-powered tools intended to enhance its Creative Cloud platform. These tools, which include expanded capabilities for Firefly—Adobe’s generative AI model—are designed to streamline creative processes and expedite content generation, image editing, and video production.

Market Size and Growth

Key Takeaway

- The Machine Learning Platforms dominated the market with a share of 30.2%, underscoring their essential role in building, training, and deploying generative AI models.

- On-Premise deployment commanded a 64.6% share, prioritizing data privacy and security for enterprises managing AI models extensively.

- The Solution segment accounted for 60.6% of the market, highlighting demand for comprehensive AI software packages that facilitate streamlined development and deployment workflows.

- Within functionality, Model Development (Training & Validation) represented 32.4%, indicating a strong focus on customized AI modeling for various applications.

- Predictive Analytics emerged as the leading application area with 28.8%, showcasing the vital role of generative AI in strategic decision-making and forecasting.

- The BFSI sector constituted 30.6% of overall demand, utilizing generative AI for efficient risk assessment, fraud detection, and personalized service delivery.

- Large enterprises led the market with a share of 70.5%, reflecting their capability for substantial investments, sophisticated infrastructure, and complex AI applications.

- The U.S. market alone was valued at USD 5.70 billion in 2024 and is expected to grow at a CAGR of 24.7%, driven by a vibrant innovation ecosystem and early adoption trends.

- North America remained the market leader with a share of 35.4%, supported by a mature AI landscape, skilled talent, and significant R&D investments.

Key drivers paving the way for growth in this market encompass the embedding of generative AI into widely-used software such as collaboration tools, CRM systems, and design applications, leading to immediate productivity enhancements reported by users. Furthermore, advancements in foundational AI models, substantial increases in computing power, and the widespread adoption of cloud technologies are pivotal in shaping this upward trajectory.

The escalating adoption of generative AI platforms is attributed to their effectiveness in automating routine tasks while also amplifying creativity and providing essential data-driven insights for smarter decision-making. The growing interest in agentic AI ecosystems, along with multi-agent orchestration, enhances the appeal of platforms that can evolve and adapt to shifting enterprise requirements.

Investment prospects in the generative AI software platforms arena are abundant, covering areas from foundational model development to domain-specific solutions and platform refinements that boost usability and integration. A notable flow of venture capital and corporate funding is evident in startups focusing on niche AI applications as well as hyperscalers expanding their AI frameworks and service offerings.

Role of AI and Advanced Technology

U.S. Market Size

The U.S. market for Generative AI Software Platforms is on a remarkable growth trajectory, currently valued at USD 5.70 billion and forecasted to exhibit a CAGR of 24.7%. This growth is primarily fueled by the country’s robust technology infrastructure, a dynamic startup ecosystem, and continuous advancements in AI research.

For instance, a January 2024 collaboration between Siemens and Amazon Web Services (AWS) aimed to bolster generative AI capabilities, highlighting the U.S.’s ongoing leadership in the AI domain. This strategic partnership focuses on expediting the development and deployment of AI solutions across various industries, including manufacturing and automation.

![]()

North America maintained its stronghold in the Global Generative AI Software Platforms Market, achieving a share of over 35.4% with approximately USD 6.63 billion in revenue in 2024. This dominance is attributed to the presence of leading tech corporations such as Microsoft, Google, and IBM, alongside an advanced cloud infrastructure and a thriving AI research environment.

Significant investments in AI innovation paired with increasing security concerns and early enterprise adoption have been integral in propelling market expansion. The enhanced demand for AI-driven automation and security solutions further contributes to the growth of generative AI software platforms in North America.

For example, during the April 2024 Google Next 2024 conference, Google Cloud introduced a suite of AI-driven tools designed for channel partners, reaffirming the region’s leadership in generative AI technology. Through these innovations, businesses can swiftly deploy AI solutions, from automating workflows to amplifying data insights.

![]()

Technology Analysis

In 2024, the Machine Learning Platforms segment emerged as the frontrunner, holding a 30.2% share in the Global Generative AI Software Platforms Market. This prevalence is largely due to widespread adoption of machine learning for essential tasks such as data analysis, automation, and content generation.

Machine learning platforms facilitate streamlined processes encompassing data preparation, model training, and system integration. These conveniences empower businesses to rapidly embrace AI solutions while benefitting from ongoing enhancements in algorithms and infrastructure, boosting their significance in the generative AI market.

For instance, in May 2025, IBM was recognized as a leader in Data Science and Machine Learning Platforms, attributed to its innovative solutions that enhance model development, data preparation, and deployment, enabling enterprises to leverage AI across a multitude of applications.

Deployment Mode Analysis

The On-Premise segment ruled the market in 2024, commanding a remarkable 64.6% share of the Global Generative AI Software Platforms Market. This dominance stems from businesses’ preference for maintaining comprehensive control over their data and AI models.

On-premise setups provide escalated security, enhanced data privacy, and compliance with regulatory frameworks, making them particularly appealing for sectors such as healthcare, finance, and government. Organizations handling sensitive data or operating on legacy infrastructure prefer on-premise solutions to leverage greater customization and integration flexibility.

For example, in November 2024, Temenos announced its on-premise generative AI solution powered by NVIDIA’s accelerated computing, enabling real-time banking solutions. This partnership allows financial institutions to deploy AI models within their own infrastructures, ensuring compliance with strict data privacy regulations.

Component Analysis

In 2024, the Solution segment dominated the market with a 60.6% share, driven by a surging demand for holistic AI solutions that encompass model development, deployment, and management.

Solutions empower businesses with integrated platforms designed to simplify workflows, cut down operational complexity, and provide customizable tools. These all-in-one offerings enable organizations across various sectors to swiftly integrate generative AI while ensuring scalability and operational efficiency.

For example, in September 2024, SLB and NVIDIA announced a collaboration to develop generative AI solutions tailored to the energy sector, merging advanced AI technologies and NVIDIA’s computing power to optimize operations, enhance decision-making, and improve predictive maintenance for energy corporations.

Functionality Analysis

In 2024, the Model Development (Training & Validation) segment took a significant share of 32.4% within the Global Generative AI Software Platforms Market. This prevalence highlights the importance of model development in establishing functional generative AI systems. Training and validation processes are pivotal in elevating model accuracy, performance, and adaptability.

Organizations across diverse sectors rely heavily on advanced training and validation tools to guarantee the reliability and scalability of their AI models. Consequently, this escalated reliance has birthed increased demand for these components.

For instance, in October 2024, EXL’s Enterprise AI Platform strengthened its partnership with NVIDIA AI software to expedite generative AI development for clients, incorporating advanced tools that streamline training and validation, supporting the swift creation of high-performing generative AI models.

Application Analysis

In 2024, the Predictive Analytics segment held a dominative market share of 28.8% within the Global Generative AI Software Platforms Market. This leadership is driven by broad reliance on AI-generated predictions for critical business decisions across multiple industries.

Generative AI facilitates the analysis of extensive datasets, enabling companies to forecast trends, discover opportunities, and mitigate risks. Its utilization in sectors such as finance, healthcare, and retail—where accurate predictions are vital for optimizing operations and enhancing customer experiences—has considerably fueled growth in this market segment.

For instance, in August 2025, Dell Technologies introduced advancements within its AI data platform powered by NVIDIA Elastic, aimed at boosting generative AI capabilities. These enhancements incorporate predictive analytics, fostering real-time data analysis and precise forecasting, enabling enterprises to streamline their decision-making processes and elevate customer interactions.

![]()

End Use Industry Analysis

In 2024, the Banking, Financial Services & Insurance (BFSI) segment captured a significant market share of 30.6% in the Global Generative AI Software Platforms Market. This leading position is attributable to the escalating requirement for AI solutions in decision-making, risk management, fraud detection, and customer engagement.

Generative AI plays a crucial role within BFSI, automating tasks such as claims processing and delivering personalized financial insights, all while enhancing operational efficiency and cutting expenses. The sector also employs AI for chatbots and virtual assistants, alongside real-time analytics, significantly improving service delivery and client engagement. Increased investments and stringent regulatory compliance further bolster this market growth trajectory.

For instance, in July 2024, OnFinance AI, based in Bengaluru, gained attention within the BFSI sector for its generative AI solutions that streamline financial operations, automating numerous functions and providing timely insights while enhancing the customer experience.

Enterprise Size Analysis

In 2024, the Large Enterprises segment commanded an impressive 70.5% share in the Global Generative AI Software Platforms Market. This prominence stems from the substantial resources, infrastructure, and comprehensive data that large corporations possess, facilitating efficient implementation and scalable generative AI solutions.

Large enterprises typically feature dedicated AI teams and robust investment capabilities, driving the demand for advanced automation and tailored services. Their considerable IT budgets, strategic partnerships in AI, and pursuit of customizable platforms that fulfill complex requirements in sectors like finance and healthcare propel the ongoing integration of generative AI.

For instance, in October 2024, Accenture partnered with NVIDIA to assist large enterprises in embracing generative AI at scale. Combining NVIDIA’s AI hardware with Accenture’s digital transformation expertise, the collaboration targets sectors like finance, healthcare, and manufacturing, aiming to enhance automation and deliver personalized services.

Top Growth Drivers

Key Trends

Key Market Segments

By Technology

- Machine Learning Platforms

- Natural Language Processing (NLP)

- Computer Vision

- Speech Recognition & Voice Processing

- Deep Learning Platforms

- Reinforcement Learning

- Others

By Deployment Mode

By Component

- Solution

- Software Tools & SDKs

- Application Programming Interfaces (APIs)

- Model Training & Deployment Infrastructure

- Data Preparation & Annotation Tools

- Others

- Services

- Professional Services

- Managed Services

By Functionality

- Model Development (Training & Validation)

- Model Deployment & Inference

- Data Engineering & ETL

- Model Monitoring & Governance

- AutoML / No-code AI Builders

- Others

By Application

- Predictive Analytics

- Natural Language Understanding (Chatbots, Virtual Assistants)

- Image/Video Analysis

- Speech Analytics

- Fraud Detection

- Recommendation Engines

- Others

By End Use Industry

- Healthcare & Life Sciences

- Banking, Financial Services & Insurance (BFSI)

- Retail & E-Commerce

- Manufacturing

- Transportation & Logistics

- IT & Telecom

- Media & Entertainment

- Energy & Utilities

- Government & Defense

- Others

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

Regional Analysis and Coverage

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Demand for Automation and Personalized Content Creation

The increasing need for automation and hyper-personalized content creation is a significant driver energizing the generative AI software platforms market. Businesses across various sectors are employing generative AI to automate tasks like code writing, text generation, image synthesis, and customer interactions, therefore saving time and lowering costs while also enhancing product quality.

The rise in digital content consumption, coupled with the need for real-time and tailored user experiences, is propelling the uptake of AI tools capable of generating diverse multimedia outputs tailored to specific audiences. The emergence of powerful large language models and multimodal AI architectures has further fueled innovation in software platforms that can accommodate these capabilities.

For example, during the June 2024 Sapphire event, SAP highlighted substantial advancements in generative AI, announcing new AI-powered solutions aimed at enhancing automation, personalization, and decision-making across enterprise applications and processes.

Restraint

Data Privacy and Security Concerns

As generative AI models require vast datasets for training, data privacy and security are becoming pressing issues. The reliance on sensitive information raises concerns about compliance with privacy regulations such as GDPR, which mandate user data protection.

Companies developing AI platforms must implement robust security measures and maintain transparent data practices to alleviate privacy concerns. Failure to adhere to these regulatory demands can lead to legal challenges and weaken user trust, subsequently hindering growth within generative AI technologies.

For example, in January 2025, heightened scrutiny emerged over data privacy and security as data models increasingly rely on sensitive consumer information. Ensuring comprehensive encryption, data anonymization, and alignment with global regulations is paramount for safeguarding user data and maintaining public confidence.

Opportunities

Innovative Applications in Industries

Generative AI harbors immense potential across a multitude of sectors, driving innovation in domains such as healthcare, finance, and education. In healthcare, AI can expedite drug discovery and enhance medical imaging, thereby refining the accuracy of diagnostics. The finance sector relies on AI for improved risk modeling and financial forecasting.

Education stands to benefit through AI’s capability to customize learning experiences, adapting content to cater to individual needs. These applications not only unlock new revenue avenues but also improve operational efficiency and tackle complex challenges with inventive AI-driven solutions crafted for specific industries.

For example, in April 2025, leading healthcare technology company Waystar launched new generative AI features across its software platform to counter inefficiencies in healthcare administration, targeting billions in waste typically accrued from manual tasks like billing and claims processing.

Challenges

Regulation and Compliance

Generative AI faces significant regulatory and compliance challenges as governments scramble to formulate frameworks for its ethical deployment. In the U.S., for example, the AI Accountability Act is aimed at enforcing transparency in AI applications, addressing key concerns such as bias and privacy.

Firms must adeptly navigate these shifting legislative landscapes, ensuring compliance with data protection norms while mitigating risks associated with misuse. Such uncertainties can stifle innovation and market expansion in the generative AI sector.

For instance, in February 2025, the European Union advanced the AI Act as the first comprehensive legislation governing artificial intelligence, shaping the generative AI software landscape and mandating ethical standards for safety, transparency, and accountability.

Key Players Analysis

In the Generative AI Software Platforms Market, several industry titans lead innovation through advanced AI model development and cloud integration. Adobe, AWS, Baidu, and C3.ai stand at the forefront, providing platforms with notable scalability and sector-specific AI capabilities.

DataRobot and Google Cloud AI Platform intensify market competition with their AutoML functionalities and ability to handle large datasets efficiently. Meanwhile, H2O.ai and Hewlett-Packard Enterprise (HPE) focus on optimizing open-source frameworks, boosting enterprise AI adoption through faster deployment cycles.

IBM Watson Studio, Intel, and Microsoft Azure AI have made considerable advances in enhancing model training efficiency and inference speed via optimized hardware and integrated development environments.

NVIDIA holds a pivotal role with its GPU-enhanced AI infrastructure, while Oracle and Palantir offer robust AI-driven analytics for sophisticated decision-making. Platforms like Salesforce Einstein and SAP SE integrate generative AI into CRM and ERP systems, refining operational efficiency, providing predictive insights, and enriching customer engagement for larger enterprises.

SAS Institute, TIBCO Software, Veritone, and Zoho’s Zia AI Platform cater to specialized sectors with focused AI applications, ranging from predictive analytics to cognitive search. These players are keen on aligning generative models with domain expertise to facilitate diverse use cases, including content generation and advanced data analytics.

Top Key Players in the Market

- Adobe Inc.

- Amazon Web Services (AWS)

- Baidu Inc.

- C3.ai

- DataRobot

- Google LLC (Google Cloud AI Platform)

- H2O.ai

- Hewlett-Packard Enterprise (HPE)

- IBM Corporation (Watson Studio)

- Intel Corporation

- Microsoft Corporation (Azure AI)

- NVIDIA Corporation

- Oracle Corporation

- Palantir Technologies

- Salesforce Inc. (Einstein Platform)

- SAP SE

- SAS Institute Inc.

- TIBCO Software

- Veritone Inc.

- Zoho Corporation (Zia AI Platform)

- Others

Recent Developments

- C3.ai launched the C3 Generative AI: Standard Edition on the Google Cloud Marketplace in early 2024. This no-code and self-service solution democratizes access to generative AI, allowing enterprise customers to extract insights effortlessly from documents and unstructured data. Additionally, the launch emphasized safe and effective generative AI adoption across sectors.

- Google Cloud AI has robustly expanded its AI offerings, unveiling over 1,000 new products and features at Google Cloud Next 2024. Emphasizing accuracy and performance, Google’s Gemini large language models aim to enhance cost-efficiency in generative AI applications and are designed to bolster broad developer adoption.