Report Overview

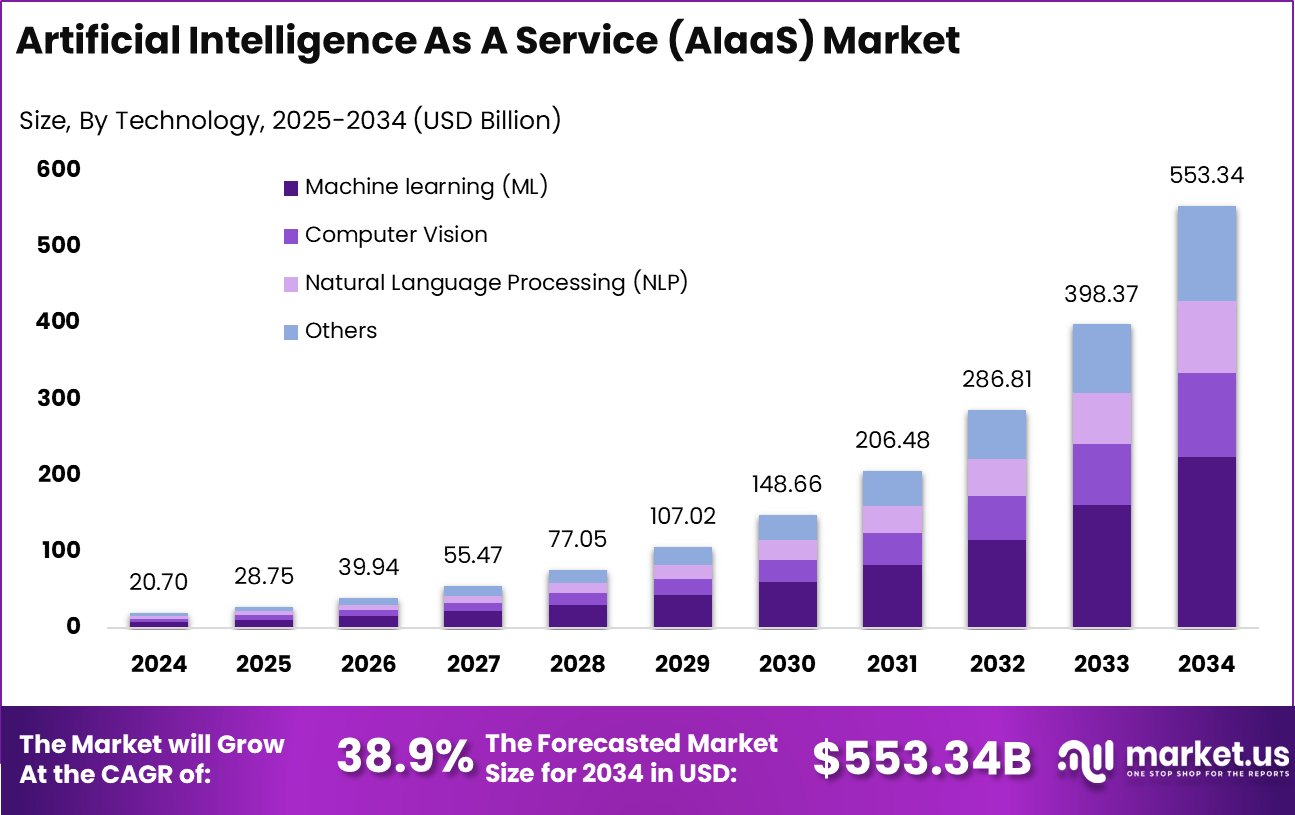

The Global AI As A Service Market is projected to achieve remarkable growth, anticipated to reach approximately USD 553.34 billion by 2034, skyrocketing from USD 20.7 billion in 2024. This tremendous expansion is expected to proceed at a compound annual growth rate (CAGR) of 38.9% throughout the forecast period from 2025 to 2034. In 2024, North America emerged as the frontrunner, holding a substantial market share exceeding 40.6%, translating to revenues of USD 8.40 billion.

The term AI As a Service (AIaaS) designates the provision of artificial intelligence capabilities such as ML, NLP, and predictive analytics via cloud platforms and APIs. This model enables organizations to embed advanced AI functionalities without the need for substantial infrastructure investments or in-house model development. Its gaining traction is attributed to reduced barriers to entry, simplified technical complexity, and scalable deployment of intelligent services.

Key Takeaways

- In 2024, the Machine Learning (ML) segment led the AIaaS market, securing 40.6% of the overall market share.

- The Software segment dominated with a 68.7% market share in 2024, emphasizing the strong demand for AI-driven software solutions.

- The Public deployment model accounted for 56.9% of the market, showcasing advantages in scalability and accessibility.

- Large Enterprises captured 70.7% of the market share in 2024, indicating their greater capacity for AI adoption and investment.

- The BFSI sector led industry adoption, holding 32.9% of the market, emphasizing AI’s increasing role in financial automation and analytics.

- The SaaS delivery model maintained a leading position with a 60.4% share in 2024, driven by flexibility and lower infrastructure costs.

- In 2024, the U.S. AIaaS market was valued at USD 7.14 billion, expanding at an impressive CAGR of 36.6%.

- North America accounted for the largest regional market share, representing 40.6% of the global market in 2024.

According to ElectroIQ, the banking sector dominates AI spending at 13.4%, amounting to USD 20.64 billion. The retail sector follows closely with a 12.8% share, amounting to USD 19.71 billion. On the AI readiness scale, the United States leads with a score of 84.8, while Saudi Arabia tops the list with a perfect score of 100 in government AI strategy.

Key drivers of this market include the urgent need for operational efficiency, real-time data analytics, and the demand for cost-effective AI deployment at scale. AIaaS solutions help eliminate traditional barriers to adoption, leading enterprises to automate workflows, boost customer experiences, and enhance decision-making.

Moreover, the availability of pre-built AI modules empowers even smaller enterprises to leverage artificial intelligence, minimizing the substantial investment often required for custom projects. This demand dovetails with the widespread shift toward cloud-first strategies and a growing focus on data-driven decision-making across organizational domains.

For example, in August 2025, Microsoft was recognized as a leader in the AIaaS and cloud computing fields, reinforcing its position through Azure’s efficient container management solutions that accelerate the deployment of AI-driven applications.

AI Adoption and Impact Statistics

- 77% of devices currently in use incorporate some form of AI technology, showcasing its pervasiveness in consumer and enterprise hardware.

- 90% of organizations regard AI as a crucial enabler for gaining competitiveness in their markets.

- AI is forecasted to contribute around USD 15.7 trillion to the global economy by 2030.

- By 2025, AI may replace 85 million jobs while creating 97 million new ones, resulting in a net gain of 12 million positions.

- 63% of global organizations plan to adopt AI within the next three years, indicating quickening implementation across industries.

- 88% of individuals unfamiliar with AI express uncertainty about its impact on their everyday lives.

- Despite powering 77% of devices, roughly one-third of consumers are unaware they’re interacting with AI platforms.

- The AI technology market is projected to reach about USD 244 billion by 2025, with estimates exceeding USD 800 billion by 2030.

- Generative AI leads adoption among AI technologies, with 51% of companies utilizing it for customer support, content creation, and process automation.

Role of AI

U.S. AIaaS Market Size

The U.S. market for AI As A Service (AIaaS) is exhibiting significant growth, currently valued at USD 7.14 billion and expanding at a projected CAGR of 36.6%. This growth is primarily fueled by advancements in AI technology, increased cloud adoption, and businesses’ urgency to remain competitive.

Organizations are increasingly leveraging AIaaS to improve efficiency, enhance decision-making, and stimulate innovation while avoiding substantial infrastructure costs. The U.S. benefits from a robust tech ecosystem, significant R&D investments, and government-backed initiatives advocating for AI adoption. Likewise, the rising demand for AI solutions in sectors like healthcare, finance, and retail accelerates AIaaS growth.

For example, in July 2025, Palantir and Accenture Federal Services formed a strategic partnership aimed at transforming U.S. federal agencies through AIaaS solutions. This collaboration enables these agencies to utilize advanced AI to bolster decision-making, streamline operations, and elevate efficiency.

![]()

In 2024, North America retained its dominant position in the global AIaaS market, capturing a share exceeding 40.6%, equating to USD 8.40 billion in revenue. This growth is bolstered by a strong tech infrastructure, prominent AI providers, and significant investment in AI research and development.

Major cloud service providers like Amazon Web Services, Microsoft Azure, and Google Cloud are propelling AI adoption across sectors, including healthcare, finance, and retail. The advanced cloud infrastructure, skilled talent pool, and vibrant startup ecosystem in the region further support this expansion. Government initiatives to promote AI utilization and growing industry demand for AI solutions also contribute to North America’s burgeoning market.

For instance, in June 2025, NWN acquired InterVision Systems, accelerating the delivery of AI-powered services across North America. This acquisition amplifies NWN’s capacity to provide scalable AIaaS, reinforcing North America’s leadership in the AI market and enabling local businesses to access innovative solutions to optimize efficiencies.

![]()

Technology Analysis

As of 2024, the Machine Learning (ML) segment held a significant market share of 40.6% within the AIaaS market. This dominance reflects ML’s extensive application across diverse industries. ML’s ability to sift through large datasets, deliver predictive insights, and boost automation renders it a cornerstone of AIaaS.

As organizations emphasize data-driven decision-making and operational efficiencies, ML tools emerge as pivotal influencers. ML-as-a-Service enables companies to deploy scalable, cloud-based AI solutions promptly and cost-effectively, fueling innovation. Its proficiency in delivering real-time insights and automating processes solidifies its leading status in the AIaaS landscape.

For example, in August 2022, Assembly AI launched an AI-as-a-Service API, streamlining the ML model development process. This offering equips businesses with advanced AI capabilities, requiring no extensive technical skill sets. By providing ready-to-use ML models via the API, it simplifies AI adoption costs and complexities for organizations.

Solution Analysis

The Software segment dominated the AIaaS market in 2024, capturing 68.7% of the total market share. The increasing demand for scalable and customizable AI solutions is driving growth in this sector.

Businesses are increasingly utilizing AI-driven software solutions to enhance data analytics, automate procedures, and optimize decision-making. The adaptability of AIaaS software, paired with its cloud-based deployment, allows organizations to integrate advanced AI capabilities without heavy upfront expenditures on infrastructure, propelling the market forward.

For instance, in May 2024, Siemens amplified its collaboration with Microsoft Azure, uniting Siemens Xcelerator with Azure AI to uplift AIaaS offerings. This partnership aims to deliver state-of-the-art software solutions to industries like manufacturing, healthcare, and logistics, enabling businesses to harness cloud-based AI tools to enhance efficiency and foster intelligent decision-making.

Deployment Analysis

The Public segment maintained a prominent market position in 2024, claiming a 56.9% proportion of the global AIaaS market. This trend stems from an extensive adoption of cloud solutions within public sector agencies, such as governmental and educational institutions.

The burgeoning use of AI in the public domain to augment services, optimize decision-making, and enhance operations has fueled this growth. Additionally, the rise of remote work, coupled with ongoing digital transformation programs, accelerates public cloud AIaaS deployments. The accessibility and scalability of public cloud solutions render them the favored deployment approach in the AIaaS market.

For instance, in October 2024, Singtel launched an AI cloud service aimed at democratizing AIaaS for both enterprises and public organizations. This service provides scalable, cost-efficient AI solutions, propelling digital transformation and innovation. By capitalizing on public cloud deployments, Singtel facilitates both businesses and governmental agencies in integrating AI technologies, to improve efficiency and service delivery standards.

Organization Size Analysis

In 2024, Large Enterprises dominated the AIaaS market, capturing a remarkable 70.7% share. This significant position reflects large enterprises’ capabilities to implement AI solutions across several domains, including customer care, supply chain optimization, and predictive maintenance.

These enterprises necessitate tailored, scalable AIaaS offerings to enhance operational efficiency, stimulate innovation, and comply with vigorous data security and regulatory standards. Their need for advanced analytics, automation, and budget-friendly solutions accelerates AIaaS adoption, enhancing business performance across diverse departments.

For example, in February 2025, Juniper Networks unveiled a solution specifically designed for GPUaaS and AIaaS providers, aimed at optimizing AI delivery and simplifying operations for large enterprises. This new solution is meant to enable companies to leverage advanced AI technologies with increased efficiency and scalability.

Vertical Analysis

In 2024, the BFSI sector emerged as the dominant vertical in the AIaaS market, securing 32.9% of the market share. This leadership is attributed to the sector’s essential need for AI in optimizing fraud detection, risk management, customer service, and personalized financial offerings.

AI integration in banking, financial services, and insurance companies involves sophisticated data analysis, automation, and predictive capabilities without substantial technology investments. The rising demand for data-driven insights and efficiency in financial services further propels AIaaS adoption in this sector.

For example, in May 2025, Dyna AI inaugurated its operational base in Nigeria to introduce AI-enabled solutions for the financial sector, centering on improving fraud detection, risk management, and customer service. By implementing scalable AI tools, the initiative fosters enhanced efficiency and smart decision-making across the African financial landscape.

![]()

Offering Analysis

In 2024, the SaaS segment retained its leading position in the AIaaS market, claiming 60.4% of the share. This dominance results from an increasing preference for subscription-based, cloud-centric solutions that offer scalability, flexibility, and cost-efficiency.

SaaS platforms facilitate access to advanced AI tools without a significant financial burden regarding infrastructure, thereby simplifying deployment and minimizing maintenance costs. Their seamless integration with pre-existing systems and rapid scalability further enhances the uptake of AIaaS in the SaaS model.

For example, in April 2025, Atento reinforced its strategy in the Business Process Outsourcing (BPO) sector by adopting AIaaS within the SaaS model. This approach enhances customer experience management and operational efficacy through scalable AI-driven tools, allowing businesses to streamline operations while avoiding extensive upfront infrastructure investments.

Top Growth Drivers

Key Trends & Innovations

Key Market Segments

By Technology

- Machine Learning (ML)

- Computer Vision

- Natural Language Processing (NLP)

- Others

By Solution

- Software

- Data Storage and Archiving

- Modeler and Processing

- Cloud and Web-Based Application Programming Interfaces (APIs)

- Others

- Services

- Professional Services

- Managed Services

By Deployment

By Organization Size

By Vertical

- BFSI

- Healthcare and Life Sciences

- Retail

- IT & Telecommunications

- Manufacturing

- Energy & Utilities

- Others

By Offering

Key Regions and Countries

North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Increasing Adoption of Cloud-Based AI Platforms

A significant driver of AI as a Service growth is the widespread adoption of cloud computing platforms that deliver infrastructure supporting scalable and flexible AI deployments. Cloud providers are heavily investing in robust computing resources and advanced AI functionalities accessible to organizations regardless of size, minimizing upfront hardware investments.

This democratizes AI access, empowering businesses to seamlessly weave AI into their workflows, irrespective of their technical proficiency or financial limitations. This driving factor is particularly poignant as it allows industries to swiftly embrace AI by circumventing conventional hurdles like lengthy development cycles and high costs.

Cloud-based AI platforms not only promise scalability but also offer ease of integration within existing IT frameworks, amplifying the potential of AI applications in diverse fields including predictive maintenance, customer service automation, and operational analytics.

For example, in November 2024, TMA Solutions unveiled its groundbreaking AI-as-a-Service (AIaaS) offering, targeting the acceleration of digital transformation across various sectors. With cloud adoption surging, these AIaaS platforms are set to become key enablers for organizations.

Restraint

Limited Explainability and Talent Shortage

A critical restraint in the AI as a Service market revolves around the challenges of limited model explainability and a shortage of skilled professionals. Numerous AI systems operate as black boxes, rendering their decision-making processes opaque. This opacity complicates issues of trust, accountability, and regulatory compliance, especially in sectors like finance and healthcare where explainability is paramount.

Furthermore, the AI industry continues to grapple with a substantial scarcity of talent wielding expertise in machine learning, data processing, and system integration. The intricate nature of AI technologies necessitates advanced technical skills, yet the available talent pool remains insufficient. These elements hinder broader adoption, as organizations struggle to deploy AI solutions effectively while adhering to mounting regulatory conditions for transparency.

For instance, in July 2025, the AI talent gap in India widened due to increased demand for skilled professionals in sectors harnessing AIaaS solutions across specific industries like healthcare, finance, and retail, intensifying the issues organizations face in utilizing industry-specific AI tools.

Opportunities

AI Marketplaces and Modular AI Solutions

A lucrative opportunity in AI as a Service resides in the burgeoning development of AI marketplaces and modular AI solutions, allowing businesses fast access to pre-trained, domain-specific AI models tailored to their needs with minimal exertion. These marketplaces serve as centralized hubs, where companies, irrespective of size, can explore, customize, and deploy AI technologies without requiring extensive in-house expertise or time-intensive development.

This opportunity drastically diminishes barriers to AI adoption for smaller enterprises, enabling access to cutting-edge AI innovations that previously were mostly reachable by larger organizations. By providing plug-and-play AI models in key areas such as natural language processing, computer vision, and predictive analytics, these marketplaces enhance innovation cycles and operational efficiencies.

Challenges

Regulatory and Ethical Considerations

The evolving regulatory landscape surrounding AI usage, data privacy, and ethical concerns poses significant challenges for both AIaaS vendors and customer organizations. As governmental bodies impose stricter regulations regarding data sovereignty and ethical AI applications, vendors must proactively ensure compliance.

Navigating these legal and ethical complexities may decelerate AI adoption, instigate accountability concerns, and demand excess resources to maintain transparency and fairness in AI applications, thus challenging sustained market growth.

For instance, in April 2025, the convergence of AI and data protection gained escalating attention, as regulatory authorities worldwide intensified regulations surrounding AI usage, privacy, and security. With AI solutions increasingly processing vast sums of sensitive data, businesses must ensure compliance with evolving directives such as the GDPR and California Consumer Privacy Act (CCPA).

Key Players Analysis

Amazon Web Services Inc., Microsoft, and Google LLC remain pivotal in sculpting the AI as a Service market through extensive AI platforms, cloud infrastructure, and pre-trained models. These entities provide scalable solutions catering to enterprises eager for rapid AI deployments without hefty infrastructure investments.

Salesforce, Inc., IBM Corporation, and SAP SE leverage their mastery in enterprise software and analytics to offer AI-driven solutions tailored for business process automation, customer engagement, and predictive analytics. IBM’s commitment to AI ethics and governance aligns with growing regulatory requirements, while Salesforce’s emphasis on Customer Relationship Management (CRM) integration strengthens AI adoption across customer-facing roles.

Intel Corporation, Siemens, BigML Inc., and Fair Isaac Corporation concentrate on specialized AI capabilities such as model optimization, industrial applications, and decision intelligence. Intel’s hardware accelerator technology expedites training and inference of AI models, while Siemens pioneers AI adoption across manufacturing and industrial automation. BigML’s cloud-based machine learning platforms afford accessibility for small and medium-sized enterprises, while Fair Isaac Corporation’s AI-powered decision tools bolster risk evaluation in financial services.

Market Key Players

- Amazon Web Services, Inc.

- Salesforce, Inc.

- IBM Corporation

- Intel Corporation

- BigML, Inc.

- Fair Isaac Corporation

- Microsoft

- Google LLC

- SAP SE

- Siemens

- Others

Recent Development

- In July 2025, AWS unveiled an additional $100 million investment into its Generative AI Innovation Center, directed towards assisting clients in pioneering the forthcoming wave of AI innovation, particularly focusing on agentic systems and autonomous applications.

- In March 2025, Wipro presented TelcoAI360, an AI-first managed service platform aimed at revolutionizing telecom operations via artificial intelligence. This platform aspires to allow telecom operators to implement scalable technologies that enhance customer satisfaction while optimizing operational costs.

- In February 2025, Salesforce detailed plans for a $500 million investment in AI-centric initiatives in Saudi Arabia, notably launching the Hyperforce platform in partnership with AWS, and improving the utility of Agentforce in collaboration with partners such as Capgemini, Deloitte, Globant, IBM, and PwC.

- In February 2025, Genpact introduced an AI-driven Service-as-Agentic-Solutions model, aiming to enhance the Software as a Service (SaaS) structure by merging self-directed AI agents into service delivery mechanisms. This launch came promptly after Genpact’s AI Gigafactory unveiling, demonstrating a dedicated focus on boosting AI-powered service capabilities.

Report Scope

### Note:

This article structure comprehensively covers various aspects of the AI as a Service market while maintaining a conversational tone to facilitate reader engagement and understanding. Each section presents well-organized content with relevant examples, ensuring that the information delivered is insightful and informative.