Exploring the Rise of Explainable AI in Banking

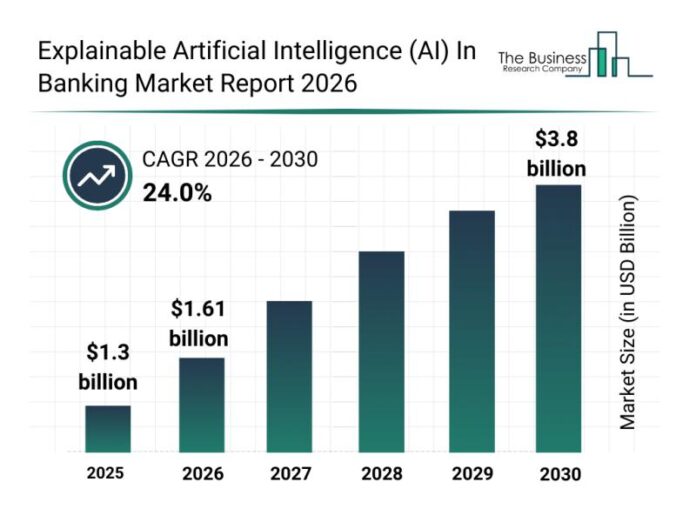

The banking sector is witnessing a transformative shift with the adoption of explainable artificial intelligence (AI). This innovation is poised to reshape how banks handle risk management, compliance, and customer transactions with unprecedented transparency. The explainable AI market in banking is projected to grow significantly, potentially reaching a value of $3.8 billion by 2030. Factors such as regulatory compliance and advanced AI-driven tools are driving this expansion. Companies are rapidly developing solutions that integrate seamlessly with banking systems, offering interpretability and enabling detailed audits. This trend is becoming pivotal as banks seek to enhance decision-making processes in a transparent and regulatory-compliant manner.

Key Insights

- The explainable AI market in banking is expected to grow at a CAGR of 24.0%, reaching $3.8 billion by 2030.

- Major industry players like Microsoft, IBM, and SAP are leading the development of transparent AI solutions.

- Recent acquisitions, such as Aurionpro’s purchase of Arya.ai, highlight strategic movements in the sector.

- Innovative solutions like Temenos’ AI Transaction Classification tool are providing banks with transparent and auditable systems.

- Explainable AI solutions are crucial for meeting regulatory standards and fostering customer trust.

Why This Matters

Transforming Risk and Compliance

Explainable AI is revolutionizing risk assessment and compliance management in banks. These AI systems provide clear insights into decision-making processes, allowing banks to justify actions to regulators and customers. This transparency is vital in environments where regulatory scrutiny is increasing and compliance costs are soaring.

Enhancing Customer Trust

By providing transparent insights into transaction processing, explainable AI fosters trust between banks and customers. These solutions clarify how AI models analyze customer data, ensuring that decisions are fair and unbiased. This clarity is becoming a competitive advantage for banks aiming to enhance customer relations.

Integration with Core Banking Systems

The seamless integration of explainable AI with existing banking systems is crucial for operational efficiency. These AI tools not only improve risk assessments but also enhance credit scoring systems, providing banks with robust decision-making capabilities. Sophisticated APIs and cloud-based solutions are aiding this integration, making AI implementation more accessible and scalable.

Bias Detection and Fairness Evaluation

Explainable AI is equipped to detect biases and ensure fairness in AI-driven decisions. This ability is imperative in maintaining equitable financial services. By embedding bias detection tools into core banking systems, banks can uphold ethical standards while positioning themselves as leaders in responsible AI usage.

Strategic Acquisitions and Industry Movements

Strategic acquisitions, such as Aurionpro acquiring Arya.ai, are reshaping the competitive landscape. These movements underscore the importance of AI capabilities tailored for transparency and regulatory readiness. As more companies like Temenos release innovative solutions, the pressure mounts for others to enhance their explainable AI offerings.

What Comes Next

- Continued expansion in AI-driven risk and credit assessments tailored for transparency.

- Increased adoption of cloud-based explainability solutions for flexibility and scalability.

- Further strategic alliances and acquisitions to boost AI capabilities in banking.

- Development of enhanced bias detection mechanisms within AI models.

Sources

- The Business Research Company ✔ Verified

- The Business Research Company ● Derived

- Unknown