Evaluating the LSTM-DQN Model for Predicting USD/INR Exchange Rates

Introduction

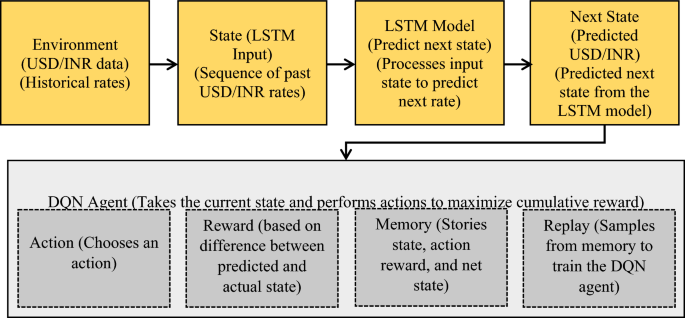

The study of currency exchange rates is increasingly critical in today’s volatile financial markets. As one of the most traded currencies among emerging markets, the Indian Rupee (INR) and its exchange rate with the U.S. Dollar (USD) are shaped by numerous factors, including macroeconomic indicators like inflation, crude oil prices, and gold prices. The proposed Long Short-Term Memory Deep Q-Network (LSTM-DQN) model aims to improve the accuracy of such predictions, providing a significant leap over conventional methodologies.

Dataset Overview

The foundation for evaluating the LSTM-DQN model includes a comprehensive dataset detailing USD/INR exchange rates alongside vital economic indicators such as inflation rates, gold prices, and crude oil prices. This diverse data pool allows for a multi-faceted approach to understanding the factors that impact the exchange rate dynamically.

Before feeding this dataset into the model, data preprocessing and normalization steps were employed, ensuring that the model could effectively learn from the data without biases introduced by scale disparities.

Benchmarking Against State-of-the-Art Models

To validate the proposed model’s efficacy, benchmarking against existing leading approaches, such as:

- Multimodal Fusion-Based LSTM (MF-LSTM): Integrates multiple data sources for predictions, although lacks reinforcement learning adaptability.

- AB-LSTM-GRU: Combines LSTM and GRU in an AdaBoost framework, ensuring robustness but slightly limited in adaptability.

- TSMixer: A transformer-based architecture noted for time-series forecasting but struggles with dynamic adjustments.

- Hybrid LSTM Models: Utilize technical and macroeconomic indicators, lacking iterative optimization.

- Two-Layer Stacked LSTM (TLS-LSTM): Enhances long-term dependency modeling without reinforcement learning elements.

Economic Significance of USD/INR

The USD/INR exchange rate is not merely a statistical number; it holds profound economic significance. India’s economy, marked by its status as a major oil importer, experiences fluctuations in the USD/INR rate due to global oil price movements and geopolitical events. Understanding the dependencies between the currency rates and macroeconomic indicators is essential for financial planners, multinational corporations, and policymakers alike.

Influential Economic Indicators

-

Gold Prices: There exists a correlation between gold prices and the USD/INR exchange rate. As depicted in previous analyses, fluctuations in gold often align with changes in the INR/USD rate, though these relationships can be non-linear.

-

Crude Oil Prices: The relationship between crude oil prices and the INR/USD exchange rate also shows a positive correlation. An increase in oil prices can lead to a corresponding rise in the exchange rate, yet the relationship exhibits clustering and outlier behavior.

- Inflation Rates: Understanding how inflation correlates with currency fluctuations is vital. The inflation rate can exert a downward pressure on the value of a currency, thus influencing the USD/INR exchange rate.

Model Training and Environment

Experiments were conducted in an advanced Python environment, utilizing TensorFlow and PyTorch libraries, enhanced by an NVIDIA GPU to accelerate model training and testing processes. This setup allowed for iterative testing, validation, and optimization of the LSTM-DQN model.

Model Performance Evaluation

The findings clearly illustrate that the LSTM-DQN model not only surpasses traditional benchmarks in terms of prediction accuracy but also exhibits outstanding adaptability to changing market conditions. Metrics such as Mean Squared Error (MSE) and Root Mean Squared Error (RMSE) reflected a significant performance improvement over alternative methods:

- LSTM-DQN Model: Achieved an MSE of 0.37 and RMSE of 0.61.

- MF-LSTM: MSE was 0.62, indicating lower prediction accuracy.

- AB-LSTM-GRU: Showcased an MSE of 0.54.

- TSMixer: MSE reached 0.49.

Statistical Significance of Results

A series of paired t-tests demonstrated that the improvements presented by the LSTM-DQN model compared to traditional models yield statistically significant results (p < 0.05). This firmly reinforces the model’s capacity to offer a reliable framework for exchange rate forecasting.

Ablation Study Insights

The significance of each component in the LSTM-DQN architecture was evaluated through an ablation study. This analysis highlighted the profound impact of combining LSTM’s sequence learning with the reinforcement-driven optimization capabilities of DQN. The full LSTM-DQN configuration yielded exceptional performance metrics compared to isolated components, emphasizing the model’s robustness in capturing the interconnectedness and temporal dependencies inherent in financial data.

Conclusion

The proposed LSTM-DQN model serves as a robust alternative to traditional exchange rate forecasting methodologies. By employing advanced deep learning techniques integrated with reinforcement learning, it demonstrates unmatched adaptability and predictive accuracy in the context of the tumultuous financial landscape that characterizes the USD/INR exchange rate.

As the financial ecosystem continues to evolve, adopting such integrated models represents a crucial step in refining and enhancing forecasting accuracy, providing invaluable tools for traders, analysts, and decision-makers.