The Evolution of Decision-Making Under Risk: A Historical Perspective

The study of decision-making under risk has a rich historical background, with foundational theories shaping our understanding of how individuals assess probability and evaluate outcomes. This article delves into seminal works that laid the groundwork for contemporary theories in behavioral economics and decision theory.

Early Theories: Bernoulli and the Measurement of Risk

Daniel Bernoulli’s 1738 paper, "Exposition of a New Theory on the Measurement of Risk," is often cited as a cornerstone in the field of decision-making under uncertainty. Bernoulli proposed that utility, rather than monetary value, should drive decision-making. He introduced the concept of expected utility, suggesting that people weigh potential outcomes based on their perceived value, leading to more rational decision-making. This paper not only sparked interest in risk assessment but also prompted further exploration into how humans value uncertain outcomes.

Reference: Bernoulli, D. (1954). Exposition of a new theory on the measurement of risk. Econometrica, 22, 23–36. View on Google Scholar

The Rise of Behavioral Economics: Tversky and Kahneman

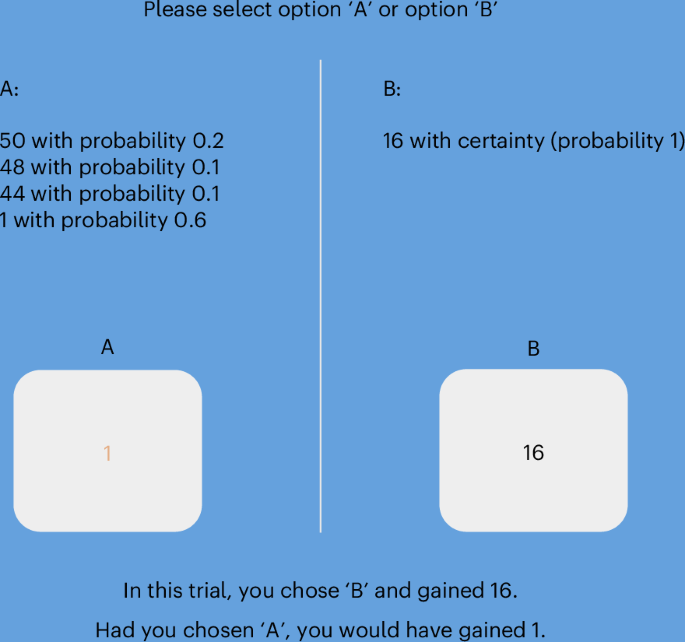

The collaboration between Amos Tversky and Daniel Kahneman produced a revolutionary framework called prospect theory, which challenged traditional economic assumptions of rationality. Their work, "Prospect Theory: An Analysis of Decision Under Risk," revealed that people value gains and losses differently, exhibiting systematic biases such as loss aversion—where the pain of losing is more impactful than the pleasure of gaining.

In their later paper, "Advances in Prospect Theory," they expanded their original model, introducing cumulative representation of risk and outlining how individuals make choices based on potential outcomes rather than absolute probabilities. This marked a significant shift, as it illuminated the psychological factors influencing decision-making.

Reference:

-

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47, 263–292. View on Google Scholar

- Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: Cumulative representation of uncertainty. J. Risk Uncertain, 5, 297–323. View on Google Scholar

Game Theory’s Influence: von Neumann and Morgenstern

While the focus of Bernoulli, Tversky, and Kahneman lay primarily in psychological perspectives, the work of John von Neumann and Oskar Morgenstern in "Theory of Games and Economic Behavior" significantly influenced decision-making models through game theory. Their mathematical approach to strategic interactions among rational decision-makers contributed to the understanding of multi-player environments and laid the foundation for economic behavior analyses.

Reference: von Neumann, J., & Morgenstern, O. (1947). Theory of Games and Economic Behavior. Princeton University Press.

Contemporary Models and Machine Learning

More recent studies have leveraged machine learning and large-scale experimental data to deepen our understanding of human decision-making. For example, the work by Erev et al., titled "From Anomalies to Forecasts," integrated descriptive models with empirical data, allowing researchers to model decision-making under both risk and uncertainty effectively.

Moreover, the exploration of cognitive models and their relationship to machine learning has opened new avenues for evaluating decision-making effectiveness in various contexts.

Reference: Erev, I., Ert, E., Plonsky, O., et al. (2017). From anomalies to forecasts: toward a descriptive model of decisions under risk, under ambiguity, and from experience. Psychol. Rev., 124, 369–409. View on Google Scholar

The Intersection of Psychology and Economics

Investigations into decision-making have not just remained the domain of economists; they have increasingly encompassed psychological insights. For instance, studies by Kahneman and Tversky revealed how cognitive biases affect economic decisions. This intersection underscores the importance of understanding not only the choices people make, but also the underlying psychological mechanisms that drive these choices.

Recent explorations by researchers such as Peterson et al. delve into how machine learning can complement traditional behavioral models, showcasing the shift towards data-driven methodologies that seek to comprehend complex human decision patterns.

Reference: Peterson, J. C., Bourgin, D. D., Agrawal, M., et al. (2021). Using large-scale experiments and machine learning to discover theories of human decision-making. Science, 372, 1209–1214. View on Google Scholar

Implications for Future Research

The continuous evolution of decision-making theories, from Bernoulli’s early insights to contemporary machine learning applications, sets the stage for future research in behavioral economics and cognitive science. As researchers uncover more about how decisions are made under risk, there will be newfound opportunities to apply these insights in areas like policy-making, finance, and technology development, enhancing our collective understanding of human behavior in complex environments.

The interplay between risk perception, psychological biases, and economic theory will no doubt serve as a fertile ground for inquiry, demonstrating the necessity of integrating diverse fields to paint a holistic picture of decision-making processes.