China Industrial Robotics Market Summary

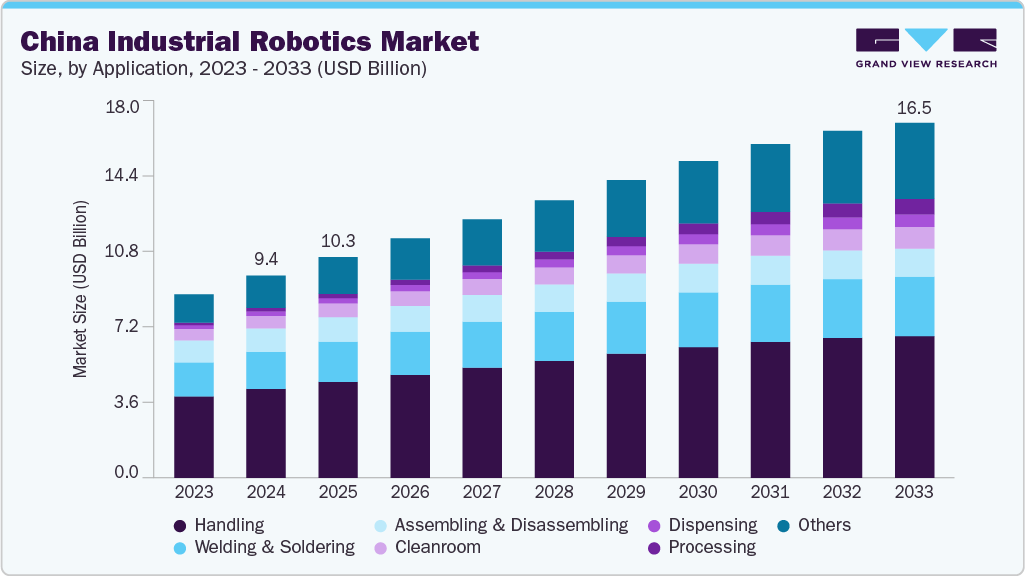

The industrial robotics market in China is poised for substantial growth, with estimates placing its size at approximately USD 9,423.9 million in 2024. Projections indicate that it could soar to USD 16,545.0 million by 2033, representing a compound annual growth rate (CAGR) of 6.1% from 2025 to 2033. This remarkable expansion is largely fueled by several key factors such as rising automation demand across critical manufacturing sectors like electronics and automotive.

Rapid Industrial Automation

The drive towards automation in China has intensified due to rising labor costs and an aging workforce. As manufacturers seek to bolster productivity, robotics provides a viable solution for maintaining efficiency and quality control. In a landscape where labor shortages are becoming increasingly apparent, the adoption of industrial robots has accelerated dramatically.

Moreover, the shift toward smart manufacturing is enhancing operational efficiency, which in turn supports the aggressive growth of the industrial robotics sector. Through innovative automation solutions, companies can enhance their quality control processes and optimize production schedules, making industrial robots a central cog in the machinery of modern manufacturing.

Government Initiatives and Investments

Government backing is another critical component propelling market growth. For instance, in March 2025, the China National Development and Reform Commission unveiled a state-sponsored venture capital fund aimed at attracting nearly RMB 1 trillion over the next 20 years. This funding is earmarked for advancing robotics, artificial intelligence (AI), and smart manufacturing, illustrating a robust commitment to domestic innovation and deployment.

This combination of strong governmental support, financial incentives, and strategic planning is designed to propel the industrial automation sector forward, fostering a conducive environment for robotics to flourish.

Advancements in AI and Robotics

The continuous advancement in AI-powered industrial robots is significantly impacting the market. These robots are increasingly used for a variety of tasks such as floor cleaning, material handling, and assembly, enhancing efficiency and lowering labor costs. Their integration of AI technologies allows for improved accuracy and responsiveness, particularly in the manufacturing and service sectors.

The emphasis on innovation and increased production capabilities contributes significantly to the market’s momentum, spurring growth across a diverse range of industries including automotive, electronics, and healthcare.

Collaborative Robots and Regional Hubs

The rise of collaborative robots (cobots) has transformed the landscape of industrial robotics in China. Cobots are designed to work alongside human workers safely, making them particularly appealing to small and medium-sized enterprises (SMEs) and specialized sectors that may not have previously embraced automation.

Cities like Beijing, Shanghai, Shenzhen, and Guangzhou are emerging as innovation hubs, focusing on the development of robotic applications for diverse sectors. This regional dynamism is facilitating customized automation solutions, democratizing access to robotic technologies, and nurturing a fertile ground for innovation throughout the country.

Strategic Approaches by Major Companies

Major players in China’s industrial robotics landscape are leveraging strategic approaches to capitalize on the opportunities arising from rapid automation growth. A number of global and domestic firms are making significant investments in local manufacturing and R&D facilities, tailoring their robotic offerings to meet the specific needs of China’s diverse industrial landscape.

For instance, in July 2025, ABB Ltd. launched three new family of robots from its Shanghai Mega Factory, integrating AI and cloud technologies aimed at providing scalable solutions particularly for the mid-market and SMEs. Such initiatives are expected to play a crucial role in boosting market growth over the coming years.

Application Insights

The handling segment is currently leading the market, accounting for over 43% of the share in 2024. This popularity stems from the escalating need for automation in material movement and loading/unloading processes within the manufacturing industry. As labor costs continue to rise, the use of robots for handling tasks—especially in sectors like electronics, automotive, and consumer goods—is being prioritized.

Additionally, the deployment of collaborative robots and advanced sensor technologies is enhancing the efficiency and safety of handling operations, which further energizes this segment’s growth trajectory.

Processing Segment Growth

The processing segment is anticipated to exhibit the highest CAGR of over 17% from 2025 to 2033. The increase in demand for robots capable of performing complex processing tasks with high precision is linked to advances in robotic technology and a broader shift towards smart manufacturing in China. As companies look to integrate additive manufacturing (3D printing) and AI-driven automation to enhance production control, this segment stands poised for significant growth.

End Use Insights

The electrical and electronics sector captured the largest share of the market in 2024, driven primarily by the demand for high-speed and high-precision automation solutions. As China stands as a global hub for electronics manufacturing, the need for automation to maintain competitiveness is underscored by governmental initiatives aimed at bolstering the sector.

The chemical, rubber, and plastics segment is also expected to witness robust growth, with a projection of the highest CAGR during the forecast period. This growth is fueled by strict regulatory requirements concerning hazardous material handling and the demand for enhanced operational safety and efficiency.

Key Players in the Market

Noteworthy companies in the China industrial robotics market include ABB Ltd., Mitsubishi Electric Corporation, Yaskawa Electric Corporation, and emerging players like SIASUN Robot & Automation Co., Ltd. and Omron Corporation.

ABB Ltd.

ABB Ltd. stands out as a global robotics supplier with a significant presence in China. The company focuses on creating AI-driven, cost-effective robots tailored to the unique needs of Chinese enterprises, particularly within sectors such as electronics, food, and metals.

Mitsubishi Electric Corporation

As another major player, Mitsubishi Electric Corporation provides advanced industrial automation and robotics solutions, emphasizing integration with factory automation to maximize productivity.

Recent Developments

Recent trends showcase a heightened pace of innovation within the sector. For example, in October 2024, SIASUN Robot & Automation Co., Ltd. unveiled the iMRS 2.0 platform, designed to meet the dynamic needs of industries like automotive manufacturing and power electronics.

Conclusion

China’s industrial robotics market stands at a critical juncture marked by substantial growth, innovation, and government support. The convergence of advanced technologies, collaborative solutions, and strategic industry initiatives positions China as a leader in the global industrial robotics arena.