Report Overview

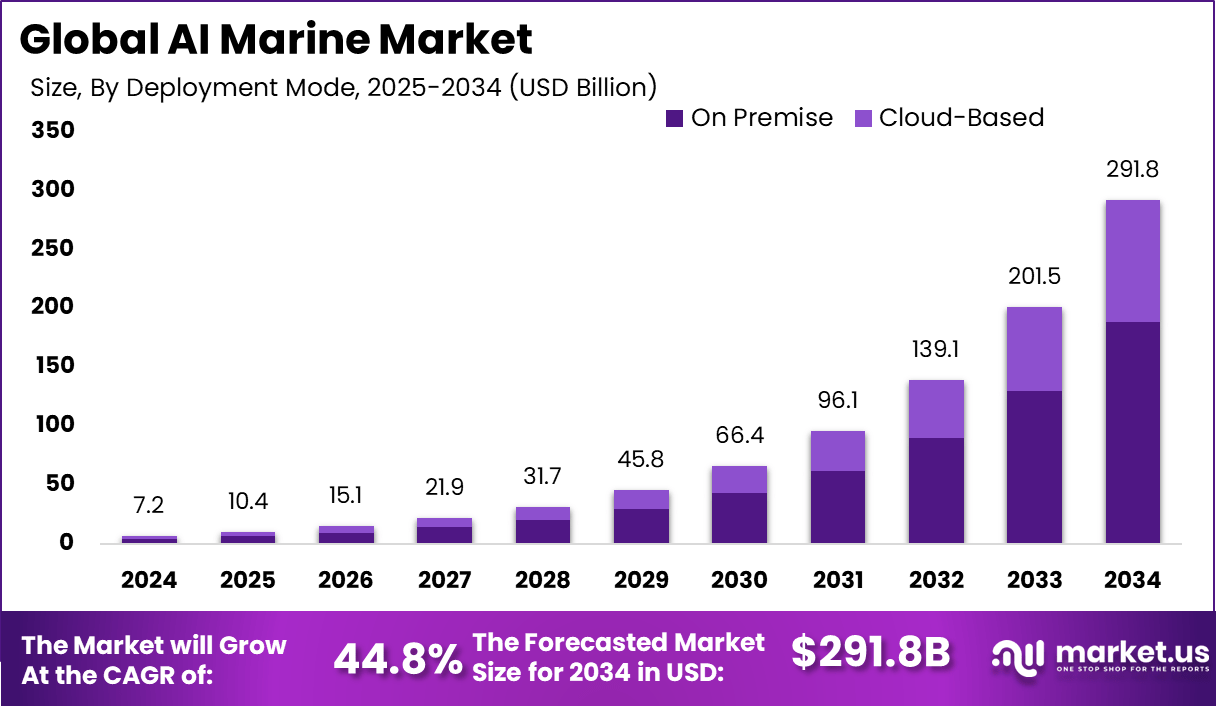

The Global AI Marine Market is poised for an impressive growth trajectory, anticipated to rise from USD 7.2 billion in 2024 to a staggering USD 291.8 billion by 2034. This surge represents a remarkable compound annual growth rate (CAGR) of 44.8% during the forecast period from 2025 to 2034. North America currently holds a significant share of this market, accounting for over 35.6% with revenues of approximately USD 2.5 billion.

The AI Marine market encompasses a broad spectrum of applications including software, autonomous vessels, underwater drones, monitoring systems, and predictive analytics solutions. This integration of artificial intelligence across maritime operations is particularly focused on enhancing logistics, environmental sustainability, safety, and naval applications. Whether in coastal waters or the deep sea, AI enhances decision-making, automation, and resilience across various marine activities such as shipping, research, defense, and conservation.

Demand Drivers in the AI Marine Market

The demand for AI solutions in marine environments is being driven by several factors including the increasing cargo traffic, the complexity of vessels, and the heightened need for real-time monitoring across fleets. Commercial shipping operators are increasingly turning to AI to gain predictive insights aimed at reducing fuel usage and minimizing unscheduled maintenance. Notably, defense and government fleets are also finding enhanced situational awareness and threat detection capabilities in AI applications.

Findings from Wifitalents reveal that 65% of shipping companies have improved their route planning efficiency with AI, resulting in reduced delays and fuel usage. Furthermore, predictive maintenance enabled by AI has led to a reduction in vessel downtime by up to 40%.

In the realm of safety, 78% of marine firms are currently investing in AI for improved monitoring and risk detection. The advent of autonomous ships has reportedly decreased crew-related costs by nearly 30%. In fact, in 2023, 55% of marine logistics companies adopted AI-driven cargo and fleet management solutions, thereby enhancing operational efficiency and cargo tracking capabilities.

Data from Gitnux indicates that AI simulations have shortened disaster response analysis times by 50%, allowing for faster emergency responses. Looking ahead, 52% of maritime companies plan to ramp up their AI investments within the next three years. The influence of AI in vessel design has resulted in a 10-15% enhancement in fuel efficiency, while real-time analytics have lowered accident risks by 22%, underscoring a growing trust in AI technologies across marine sectors.

Key Market Insights

- The AI Marine Market is projected to grow significantly, reaching approximately USD 291.8 billion by 2034, reflecting a CAGR of 44.8%.

- North America led the market in 2024, securing a 35.6% share with revenues around USD 2.5 billion, backed by strong technological adoption and a robust shipping infrastructure.

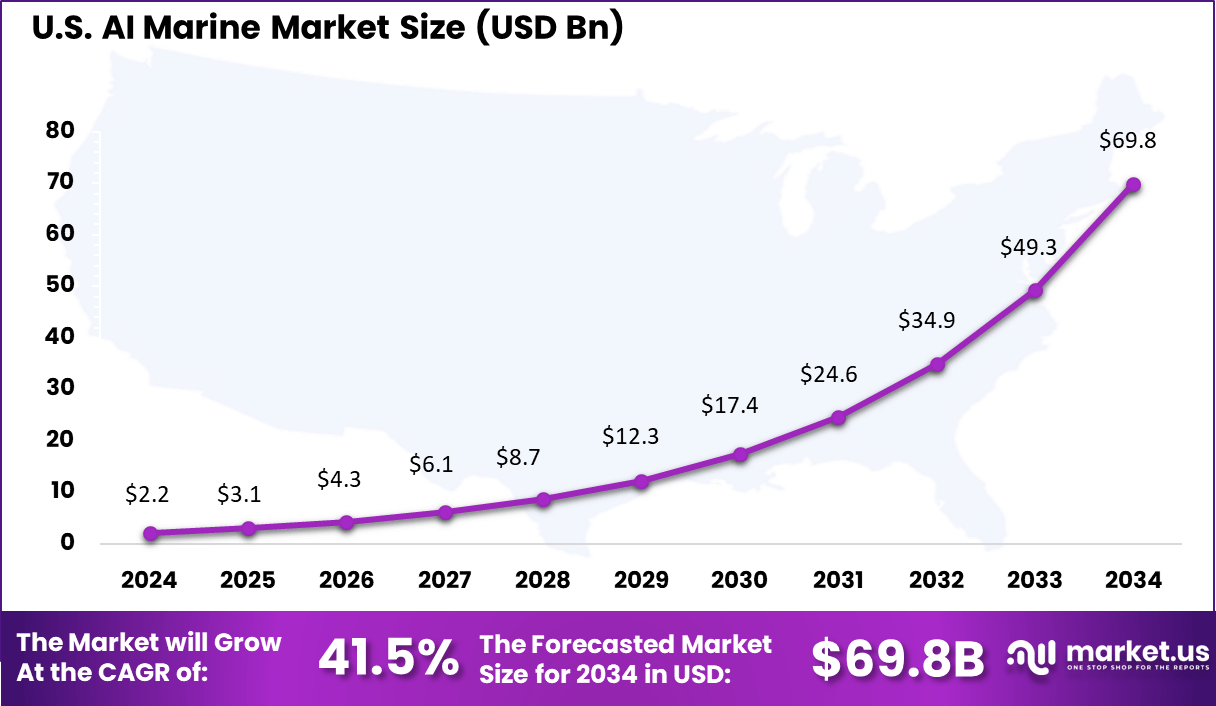

- The U.S. contributed approximately USD 2.17 billion in 2024, with a projected CAGR of 41.5%, demonstrating significant investments in AI-driven marine systems.

- Within the hardware category, AI technologies accounted for 52.7% of market share in 2024, driven by increased demand for sensors and AI-enabled devices.

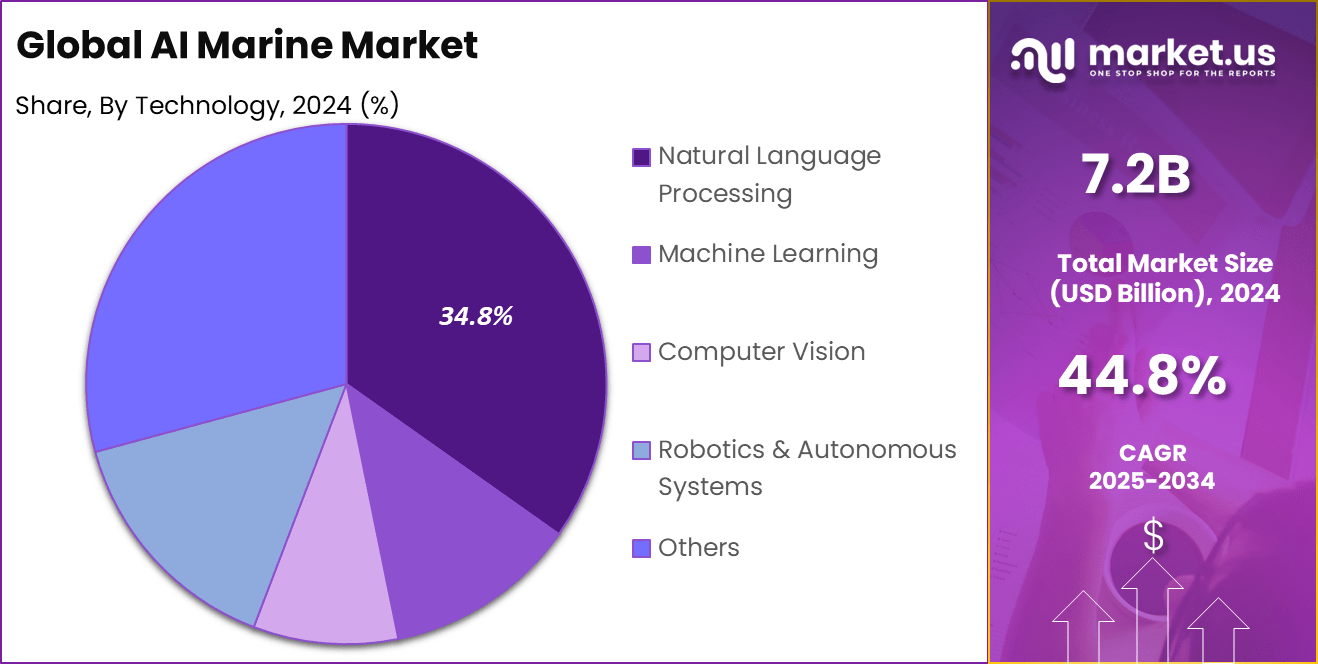

- Natural Language Processing (NLP) occupied 34.8% of the technology sector, owing to its growing significance in ship-to-shore communication and autonomous decision support.

- Navigation and route optimization emerged as the leading application with 30.5% share, emphasizing AI-driven efficiency and fuel savings.

- On-premise systems represented 64.7% of the deployment mode, showcasing the industry’s preference for localized processing of sensitive operational data.

- Commercial shipping captured the largest end-use segment with 28.9% share, fueled by global trade growth and the pursuit of smarter fleet operations.

U.S. Market Size

The U.S. AI Marine Market was valued at USD 2.2 billion in 2024 and is expected to reach approximately USD 69.8 billion by 2034, with a projected CAGR of 41.5%. North America dominates the global market, holding more than 35.6% share with revenues around USD 2.5 billion. This leadership can be attributed to advanced defense systems and the widespread adoption of autonomous marine technologies, alongside ongoing government support for naval modernization initiatives.

High utilization of AI-based navigation, vessel tracking, and predictive maintenance across both military and commercial fleets strengthens North America’s competitive edge. The early integration of AI technologies with underwater surveillance systems has greatly enhanced the region’s intelligent maritime solutions.

By Component Analysis

In 2024, the Hardware segment dominated the market, capturing over 52.2% of the total share. This dominance arises from the growing installation of AI-powered onboard systems that facilitate real-time decision-making in marine operations. Hardware types like sensors, edge processors, and marine-grade GPUs are essential for automation and predictive maintenance.

The necessity for high-performance computing in AI-based navigation systems and marine surveillance is driving demand. Investment in hardware that enables real-time emissions tracking and fuel optimization is on the rise, particularly as the shipping industry increasingly prioritizes both operational efficiency and environmental sustainability.

By Technology Analysis

In 2024, the Natural Language Processing (NLP) segment led the technology landscape, holding 34.8% of the market. This can be credited to the rising reliance on NLP for effective communication and reporting within maritime operations. The use of NLP has improved crew situational awareness, reduced potential errors, and facilitated multilingual support.

The applications of NLP extend beyond simple command interpretation; they include automated log analysis and enhanced incident reporting. Continued investments in transformer-based models such as BERT and GPT are further driving its adoption, enhancing maritime language understanding and contextual sensitivity.

By Application Analysis

The Navigation & Route Optimization segment holds a commanding 30.5% of the market share in 2024. The critical role of real-time route planning in reducing fuel consumption and enhancing safety is fueling the prominence of this segment. AI-driven navigation systems utilize dynamic data, incorporating weather forecasts, sea currents, and vessel performance metrics to recommend optimal paths.

Significantly, these systems are foundational to autonomous shipping initiatives, supporting independent and efficient routing that adheres to evolving regulatory standards.

By Deployment Analysis

In 2024, the On-Premise segment captured 64.7% of the market. This preference arises from the maritime sector’s need for complete control over data and systems, ensuring high data sovereignty in compliance with strict maritime regulations.

Local processing through on-premise systems is crucial, especially in scenarios with unstable connectivity. Ships operating in remote waters require reliable access to mission-critical AI technologies, which are best supported through locally-installed infrastructures.

By End Use Analysis

By 2024, the Commercial Shipping segment accounted for 28.9% of the market share. This is largely due to the extensive integration of AI across logistics and fleet operations, where real-time decision-making is essential. Technologies such as predictive maintenance and cargo tracking are increasingly incorporated into unified digital ecosystems to enhance efficiency and cost-effectiveness.

Meeting stringent environmental standards and sustainability targets propels the adoption of AI solutions across commercial shipping, aligning operational practices with regulatory demands.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Technology

- Natural Language Processing

- Machine Learning

- Computer Vision

- Robotics & Autonomous Systems

- Others

By Application

- Navigation & Route Optimization

- Predictive Maintenance

- Port Operations & Management

- Vessel & Cargo Tracking

- Surveillance & Security

- Autonomous Shipping

- Others

By Deployment

- On-Premise Systems

- Cloud-Based Solutions

By End Use

- Commercial Shipping

- Energy & Utilities

- Warehouse & Logistics

- Port Authorities

- Fishing Industry

- Offshore Energy

- Others

Key Regions and Countries

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend

Increasing Use of Autonomous Underwater Robotics

A noteworthy trend in the AI marine sphere is the rising use of autonomous underwater robots for maintenance tasks such as hull cleaning. These robots can conduct inspections and monitor ship conditions while the vessels remain operational, thereby optimizing maintenance routines and reducing drydock needs.

The growing popularity of these robots not only minimizes risk for human divers but also enhances maintenance efficiency. With AI capabilities, these robots can navigate underwater structures and collect critical performance data, driving overall operational integrity.

Driver

Rising Pressure to Lower Maritime Emissions

One of the most significant driving forces in the AI marine sector is the escalating pressure from global regulatory bodies to curb emissions from commercial shipping. Authorities advocate for smart technologies designed to optimize vessel performance and reduce environmental impact. As operators strive to comply with emissions regulations, AI-driven technologies for real-time decision-making become essential to enhancing fuel efficiency and minimizing operational costs.

Restraint

Limited Connectivity at Sea

A critical challenge posed to the implementation of AI in the marine sector is the limited availability of high-speed internet while at sea. Many vessels rely on expensive and often unreliable satellite communication, which complicates the deployment of cloud-based AI systems that need constant data exchange.

Opportunity

Growth of Edge AI Solutions

An emerging opportunity in the AI marine market exists in the increased adoption of edge AI systems, which facilitate data processing directly on the vessel without relying on cloud servers. This enables real-time monitoring and predictive maintenance, even in areas with limited connectivity, while also safeguarding sensitive data.

Challenge

Uncertainty Around Autonomy Regulations

The extensive implementation of autonomous marine systems is hampered by unclear legal frameworks, particularly because most maritime regulations are geared toward human-operated vessels. This creates hesitation among shipping companies looking to adopt fully autonomous technologies, with lingering uncertainties around accountability and liability in the event of incidents involving autonomous systems.

Key Player Analysis

The AI marine sector is being shaped by several innovative companies leading the charge in automation, data intelligence, and maritime safety. Key players such as Anduril Industries, Sea Machines Robotics, and Saildrone are pioneering advancements in autonomous vessel systems and unmanned technologies.

Other notable companies, including Orca AI, Nautilus Labs, and OrbitMI, focus on enhancing fleet performance through AI-driven analytics, targeting fuel efficiency and navigation optimization. Meanwhile, newer entrants like Rovco, ThayerMahan, and EyeROV are driving forward AI applications in underwater inspection and seabed mapping.

Recent Developments

- In May 2025, Anduril Industries expanded its maritime portfolio by acquiring Klas, a company recognized for edge-computing systems used in secure battlefield communications.

- In early 2025, Rovco unveiled its upgraded AI-powered perception system for deep-sea inspections using remotely operated vehicles, reportedly increasing data resolution for seabed infrastructure mapping by 35% compared to prior versions.

This overview provides a comprehensive understanding of the dynamic and rapidly evolving landscape of the AI Marine Market, highlighting the numerous factors contributing to its growth, the challenges it faces, and the exciting developments occurring within the sector.