The Growing Landscape of the Global AI Computing Hardware Market

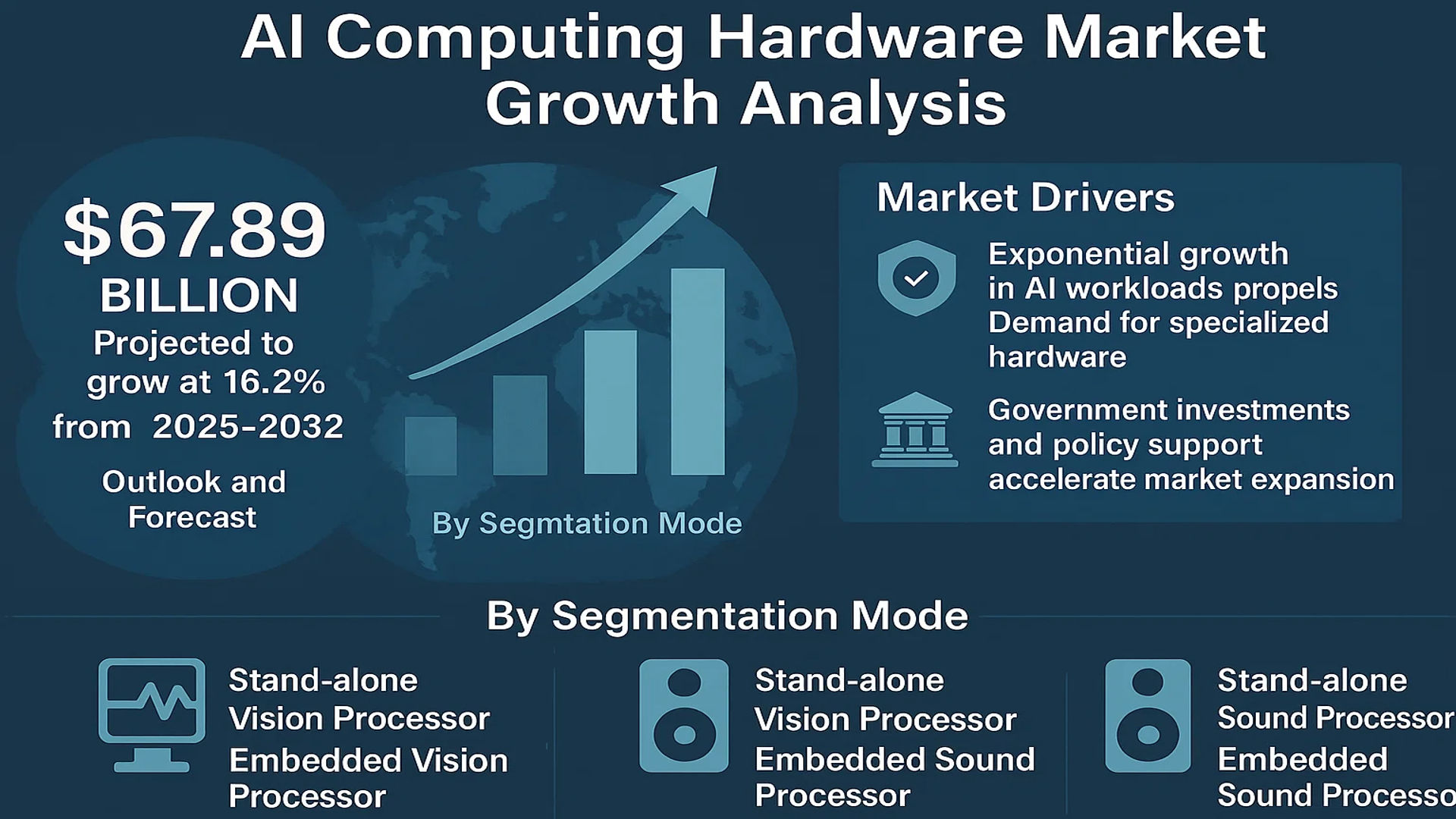

The global AI computing hardware market presents an impressive growth trajectory, showing a potential rise from a valuation of US$ 67.89 billion in 2024 to an astounding US$ 189.34 billion by 2032, marking a compound annual growth rate (CAGR) of 16.2% between 2025 and 2032. This escalation is not merely a reflection of market dynamics but embodies the profound shifts occurring across industries driven by artificial intelligence (AI) technologies.

What is AI Computing Hardware?

AI computing hardware refers to specialized semiconductor components designed specifically to accelerate AI workloads. These include processors optimized for machine learning, neural networks, and deep learning applications. The core components of this hardware ecosystem range from Graphics Processing Units (GPUs) and Tensor Processing Units (TPUs) to Field-Programmable Gate Arrays (FPGAs), Application-Specific Integrated Circuits (ASICs), and other AI accelerators tailored for high-performance computing.

Drivers of Market Growth

Several factors contribute to this burgeoning market. Primarily, the soaring demand for AI applications across diverse industries plays a pivotal role. Enterprises are increasingly recognizing the efficiency and scalability that AI can bring to their operations, resulting in a heightened need for powerful computing hardware.

Moreover, government investments in AI infrastructure have catalyzed growth. For example, the European Union has committed USD 9.8 billion to AI and supercomputing initiatives under its Digital Europe program, while U.S. non-defense AI research and development spending reached USD 1.7 billion in 2022. Such investments create an environment ripe for innovation and progress.

Leading Innovators in AI Hardware

The market is characterized by significant innovation from key players like Nvidia, Intel, and AMD. Nvidia’s H100 Tensor Core GPU stands out, showcasing performance gains of up to 30 times compared to its predecessors, particularly tailored to meet the needs of AI workloads. This innovation-centric approach positions these companies at the forefront of the AI hardware revolution.

Segment Analysis

By Type

The AI computing hardware market can be analyzed through various segments. The stand-alone vision processor segment dominates, largely due to the rising demand for edge AI solutions. Key subtypes within this segment include GPU-based, ASIC-based, and FPGA-based processors. Embedded vision processors and sound processors, both stand-alone and embedded, also contribute significantly to the market.

By Application

In terms of applications, the automotive sector leads, spurred by increasing adoption of autonomous vehicle technologies. Other significant sectors include Banking, Financial Services, and Insurance (BFSI), Healthcare, IT and Telecom, and Aerospace and Defense. The application landscape showcases the diversity in AI use cases across industries.

By Technology

As technology evolves, ASIC-based solutions are gaining traction for their energy efficiency. Organizations are actively seeking hardware that balances performance with energy consumption, making ASICs a favorable choice for many AI applications.

By End User

The demand from enterprises shows robust growth, driven by AI adoption in business processes. Cloud service providers, government initiatives, and academic institutions also make substantial contributions as they increasingly rely on AI-driven solutions.

Market Dynamics

Market Drivers

Exponential Growth in AI Workloads

The AI computing hardware market is witnessing explosive growth due to a dramatic increase in AI workloads across all sectors. Companies are adopting AI for various applications, heralding a significant surge in demand for specialized hardware that can handle the computational intensity of modern machine learning algorithms. Data centers, in particular, anticipate over 40% annual increases in AI chip deployments as traditional CPUs prove inadequate for the tasks at hand.

Government Investments and Policy Support

Countries worldwide recognize AI as a crucial strategic priority, leading to various policy implementations and funding initiatives. This commitment translates into billions of dollars aimed at shaping domestic capabilities, particularly in semiconductor manufacturing. The focus on local production of essential AI components positions nations to compete effectively in the global technology landscape.

Market Opportunities

Edge AI Expansion

The rise of edge computing is opening new horizons for AI hardware manufacturers. As AI processing moves closer to data sources, energy-efficient chips optimized for edge environments become increasingly vital. Industries like industrial IoT, autonomous vehicles, and smart cities are pioneering developments in this space, seeking specialized architectures that cater to specific edge applications.

The Convergence of AI and Quantum Computing

The intersection of AI and quantum computing offers transformative potential for the hardware market. Early-stage quantum machine learning processors show promise in solving specific problems at unprecedented speeds. While this technology is still developing, significant investments from public and private sectors are accelerating its growth, paving the way for revolutionary applications in diverse fields, such as drug discovery and financial modeling.

Emerging Trends in AI Computing Hardware

The shift toward specialized AI chip development is a noteworthy trend. GPUs currently command over 60% of this market, but Application-Specific Integrated Circuits (ASICs) and Field-Programmable Gate Arrays (FPGAs) are increasingly appearing due to their energy efficiency, particularly in edge computing settings. Neuromorphic computing chips—designed to simulate biological neural networks—are gaining attention for their potential performance advantages in real-time AI tasks.

Other Notable Trends

Edge AI Computing Expansion

The transition to edge computing is prompting innovations in low-power AI hardware solutions, especially for IoT and mobile platforms. Semiconductor manufacturers are pushing boundaries to create compact, high-performance AI processors that can operate directly on devices, thereby enhancing response times and bolstering data privacy.

Government Investments Fueling Innovation

Vast government funding for semiconductor R&D is reshaping the AI hardware landscape. The U.S. CHIPS Act is set to allocate more than $50 billion for domestic semiconductor manufacturing, while the EU aims to significantly boost its share of the global chip market. These initiatives are propelling innovative chip designs for critical applications across various sectors.

Recent Developments in the Market

- Proliferation of Edge AI Hardware Solutions: The market is experiencing a surge in the development of energy-efficient AI chips for edge devices, enhancing capabilities while reducing cloud reliance.

- Dominance of Custom AI Accelerators: Tech giants like NVIDIA and Google lead the charge in developing task-optimized AI accelerators, enhancing efficiency and performance.

- Adoption of AI Servers in Data Centers: Hyperscale data centers are increasingly deploying AI-optimized server hardware, powering vast AI workloads and applications.

- Rise of Open-Source Platforms: Startups are turning to modular and open-source hardware frameworks, allowing for cost-effective and customizable AI system developments.

- Investment in Advanced Packaging: AI chipmakers are employing cutting-edge packaging technologies to improve AI chip performance and reduce energy consumption.

Competitive Landscape

The competitive environment in the AI computing hardware market is dynamic, featuring leading semiconductor companies as well as innovative startups. NVIDIA Corporation holds a commanding market share of around 80%, driven by its advanced GPU technologies and CUDA architecture.

Intel and AMD are also aggressive contenders, continuously expanding their product lines to challenge NVIDIA’s dominance. Companies like Graphcore and Groq are emerging as notable players, developing unique AI hardware designed for specialized applications, showcasing the potential for significant market disruption.

Leading Players in AI Computing Hardware

- NVIDIA Corporation (U.S.)

- Intel Corporation (U.S.)

- Advanced Micro Devices (AMD) (U.S.)

- Qualcomm Technologies, Inc. (U.S.)

- Graphcore Limited (U.K.)

- Groq, Inc. (U.S.)

- SambaNova Systems, Inc. (U.S.)

- Cerebras Systems (U.S.)

- Hailo Technologies (Israel)

- Tenstorrent Inc. (Canada)

For Further Insights

To dive deeper into the competitive analysis and future forecasts of the AI computing hardware market, explore more resources available at Semiconductor Insight.