“2025 Trends in Bitcoin, Dogecoin, and Ripple Cloud Mining: Exploring AI-Powered Benefits and Returns”

2025 Trends in Bitcoin, Dogecoin, and Ripple Cloud Mining: Exploring AI-Powered Benefits and Returns

The Core Concept: AI in Cloud Mining

Cloud mining allows individuals to mine cryptocurrencies without investing in heavy hardware. Instead, users rent mining power from remote data centers. The incorporation of artificial intelligence (AI) enhances this process, optimizing operational efficiency and potentially increasing returns. For example, AI algorithms can analyze market data and dynamically adjust mining activities based on real-time network conditions. This adaptability boosts profitability, especially for popular cryptocurrencies like Bitcoin, Dogecoin, and Ripple.

Key Components of AI-Powered Cloud Mining

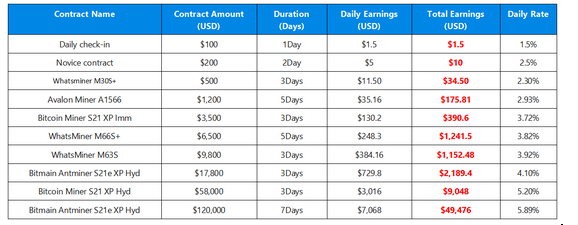

AI-powered cloud mining comprises several integral parts, including resource allocation, automated processes, and regulatory compliance. Resource allocation engines assess market trends and adjust mining power distribution accordingly. Users benefit from not only mining rewards but also earnings from liquidity pools. Regulatory compliance ensures users’ funds are protected within established legal frameworks. An instance of this is Global Cloud’s investment strategies, which are designed to yield returns between 3% and 8% based on user feedback.

The Step-by-Step Process of AI Mining

The lifecycle of AI cloud mining starts with user registration on platforms like Global Cloud. Users select their preferred mining package tailored to their investment goals. After that, the AI system optimizes resource allocation according to real-time data feeds and market conditions. As the mining operations progress, users can monitor their earnings through a dashboard, allowing for strategic decisions on withdrawals or reinvestments. This systematic approach minimizes risk while maximizing efficiency.

Practical Scenario: Real-World Implementation

Consider a newcomer utilizing Global Cloud’s 2025 AI cloud mining program. This individual registers, chooses a budget plan, and lets the built-in AI manage the complex details of mining cryptocurrencies. Unlike traditional methods that require technical knowledge, this automated solution provides a seamless experience, allowing the user to earn passive income. With the potential for an annualized return between 3% and 8%, this practical scenario emphasizes AI’s role in democratizing access to cryptocurrency investment.

Common Mistakes to Avoid in Cloud Mining

Investors frequently overspend on high-tier plans without understanding market consultations. The disconnect between expected and actual returns can lead to disappointment. To avoid this, users should thoroughly research market conditions and adjust their investment strategies accordingly. Regularly revisiting their selected plans can also lead to more informed decisions about mining versus liquidating assets, keeping in line with their personal financial goals.

Essential Tools and Metrics for Success

Effective cloud mining relies on various tools and metrics, such as real-time tracking dashboards, historical data analysis, and market sentiment indicators. These tools enable investors to gauge performance continuously and pivot quickly if market conditions shift. For instance, analytics platforms can assess which cryptocurrencies yield better returns under current conditions, enabling users to adjust their mining focus proactively. This active engagement ensures that investments are optimized for maximum profitability.

Alternatives to AI-Powered Mining

While AI-powered cloud mining offers robustness, traditional mining methods remain prevalent. These alternatives often involve purchasing hardware, which could lead to higher initial costs and ongoing operational expenses, including electricity. An advantage of traditional mining is the potential for full control over hardware and software settings, giving experienced users more autonomy. However, the scalability and convenience of AI-integrated cloud mining make it an appealing choice for many investors looking to minimize their involvement while maximizing returns.

FAQs About AI Cloud Mining

What is cloud mining?

Cloud mining allows users to mine cryptocurrencies using remote data centers, eliminating the need for expensive hardware or technical expertise.

How does AI improve mining efficiency?

AI enhances mining by optimizing resource allocation based on real-time market conditions, which can lead to increased profitability.

What are the risks associated with cloud mining?

Common risks include market volatility, potential loss of capital, and reliance on service providers. It’s crucial to research and select reputable platforms.

How much can I expect to earn with AI cloud mining?

Returns can range from 3% to 8% annually, depending on market conditions and the specific investment plan chosen.